Several years ago, the National Committee on Planned Giving undertook a national survey that revealed, among other things, that only 5% of the population had included charitable provisions in their estate plans. Another survey by U.S. Trust Bank, on the other hand, indicated that approximately 50% of affluent Americans intended to include charitable entities in their estate plans.

While both of these surveys are interesting and contain useful information, it may also be beneficial to examine the actual habits of a portion of America’s decedent population within a given time frame.

Fortunately, such information is available from the Internal Revenue Service. The most recent figures available are included in the Winter 1996/97 “Statistics of Income Bulletin.” The report features an in-depth analysis of the estate tax returns of individuals who died with gross estates of $600,000 or more in 1992.

In 1992, the most recent year for which a complete analysis is available, female decedents passed away at 80.2 years on average, while male decedents had lived to 74.6 years.

Stocks, real estate, bonds, and cash made up the lion’s share of 1992 decedents’ estates totaling almost 90% of the gross estates. Surprisingly, insurance only accounted for about 3.4% of these estates. This may be due to the tendency of older people to discontinue life insurance that is no longer needed for protection in the event of early death.

Popular deductions

The marital deduction and charitable deduction were the two most popular estate tax deductions. For estates for which a federal estate tax return was filed in 1992, a charitable deduction was claimed in 10.7% of the estates which after deductions proved to be non-taxable, and 28.8% of the taxable estates, an average of nearly 19% of the federal estate tax returns overall. Gross contributions claimed on these estate tax returns exceeded $8.4 billion. The IRS study reveals that charitable bequests in taxable estates had increased to 28.8% in 1992 from 22.5% in 1989.

The study further indicated a significant shift from marital to charitable bequests. This may be due to a greater number of taxable estates that represent the assets of the second spouse to die, as well as the increasing number and variety of planned giving options available to meet multiple personal and philanthropic objectives.

Factors affecting charitable gifts

Gender definitely affects giving patterns. Women are significantly more likely to include charitable provisions than men. This is presumably explained by the fact that women tend to live longer than men. With married couples, the first spouse would likely take advantage of the unlimited marital deduction for the surviving spouse. (See related article in June 1997 Give & Take.)

Marital status also was an important factor to consider. Single females and males were the most likely to include charitable bequests. Forty-one percent of all single females studied, and almost one third of all single males, included charitable provisions in their estate plans. Widows and widowers were the next most likely group to include charities in their estate plans.

Age at death was also a significant factor. Those persons dying between the ages of 80 and 90 represented almost half of all charitable contributors from estates. Interestingly, the largest percent of net worth was given by decedents who were between the ages of 60 and 70 at the time of death.

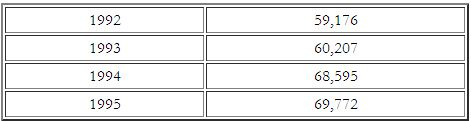

The IRS figures should provide encouragement for all persons involved in the gift planning process. The figures provide solid evidence that the growing transfer of wealth is becoming a source of increased charitable giving. Evidence of the increasing size of estates is shown by the rise in the number of federal estate tax returns Filed between 1992 and 1995:

The combined assets of the 1995 decedents increased almost 20% over the 1992 amount to $117.7 billion. These 69,772 estates represent only 3% of the 2.3 million people who died in 1992.

When considering that the U.S. Trust survey indicated 50% of its study group intended to include charities in their estates, while the NCPG study found that only 5% had actually included charitable dispositions in their estates, it appears that considerable room for growth remains.

And finally, the IRS estate tax returns indicate that about 20% of relatively wealthier Americans dying in a given year actually do include charities. One might reasonably assume that growth can be achieved by reminding those who have charitable intentions to follow through on those intentions!

Ongoing and effective communications may well be the key to making this process happen and allowing your donors to leave a lasting legacy. Future issues of Give & Take will include additional data from the IRS studies that may assist you in your gift planning efforts.

Note: The IRS “Statistics of Income Bulletin” is available from the

Superintendent of Documents, P.O. Box 371954, Pittsburgh, PA 15250-7954.