Your marketing efforts have worked, and eligible donors are beginning to make qualified charitable distributions from their IRAs to your organization. Early next year these donors will receive Form 1099-R from their custodians showing their total distributions, even though some or all of that amount was sent to charity.

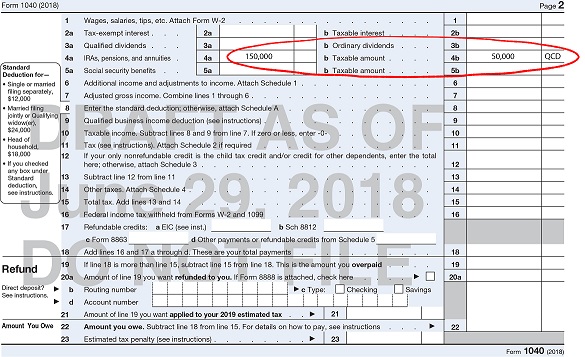

To avoid frantic phone calls, explain to donors that although the 1099-R reflects all distributions from the IRA and is reported on the 1040 form line 4a, only the taxable amount, subtracting the Qualified Charitable Distribution (QCD), is entered on line 4b, with the notation QCD following, as shown in the example below. The acknowledgment letter from your organization can include information about how QCDs are reported.

You might want to consider sending Charitable IRA information to all IRA donors and perhaps also other affluent older donors during the first quarter of the 2020 calendar year. This information could serve both as a reminder of this gift option before they have used their $100,000 IRA gift amount for 2020 and as information to share with tax preparers to make certain their gifts for 2019 are reported correctly on their 2019 return. Such action could keep some donors from being taxed on the IRA funds they distributed under the assumption that these funds would not be included as part of their taxable income.

SHARPE newkirk offers a number of resources and communications tools to help you educate your donors about the benefits of making a gift from an IRA, including a strategic marketing guide, a Charitable IRA brochure and royalty-free downloadable postcard art. Click here for more information. ■