While donors enjoy a number of options when it comes to planning gifts to charitable organizations, recent changes may lead to increased interest in tax-favored charitable trusts. Conditions including a combination of higher income and capital gains taxes and record levels of house-hold net worth are contributing to an environment that is again favorable for the creation of new charitable trusts.

An article from the Internal Revenue Service’s latest Statistics of Income Bulletin, based on an examination of tax returns filed in 2011, presents valuable information on the state of charitable trusts in America. These returns provide helpful information about nearly 120,000 charitable remainder trusts, lead trusts and pooled income funds that now hold $118 billion in assets earmarked for charitable use.

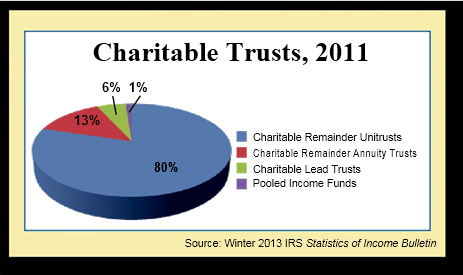

According to IRS analysis of returns, charitable remainder trusts were the most commonly reported type of what are known as “split-interest trusts” in 2011, with annuity trusts and uni-trusts accounting for more than 90 percent of all charitable trust filings. The balance was divided between charitable lead trusts and pooled income funds.

Changes could lead to increased trust activity

The financial crisis of 2008 and the Great Recession that followed contributed to a decline in the number of charitable trust filings, which dropped from 122,541 in 2009, to 118,781 in 2010 and then to 117,704 in 2011. The total drop of 4 percent,representing the difference between then numbers of new trusts and those terminating, was less than the decline in overall giving during that period.This trend was no doubt influenced by a significant reduction in the market value of publicly traded securities,which are an important funding asset for these gifts.

With the Dow Jones industrial average now approaching record levels, history reveals there may well be renewed interest in funding charitable remainder trusts using appreciated or “re-appreciated” securities. Higher maximum income and capital gains tax rates and the new Medicare tax on capital gain should also increase the attractiveness of these plans for high-income earners. See the April issue of Give & Take for more information.

Charitable benefits

The IRS study also reports trust distributions made for charitable purposes. These distributions include pay-ments to charities of both trust income and principal.

In 2011, charitable entities received just over$3 billion from charitable trusts. More than one-third, or $1 billion, came from charitable lead trusts, while $2 billion was distributed from charitable remainder trusts. Although remainder trusts greatly out-number lead trusts, in some recent years lead trust distributions to charity have been higher.

Worth noting

Even though in 2011 more than 16,000 charitable trusts were valued at $1 million or more, the vast majority of charitable remainder trusts—more than 95,000—held under $1 million in assets, confirming this giving option is attractive to more than just the highest net worth donors. In fact, with the largest number of charitable trusts falling into the under-$500,000 cat-egory, it would appear that the primary market for these gift planning tools is actually a group of affluent donors who might categorize themselves as members of the upper middle class.

Other data from the IRS indicates that the average age when creating charitable remainder trusts is the early 70s. With unprecedented numbers of baby boom-ers entering this age now and over the next 20 years, demographic shifts may also drive an era of exceptional growth in charitable remainder and lead trusts as mature Americans make plans to meet both personal and philanthropic objectives in a challenging economic environment.