In last month’s issue of Give & Take, we examined the underlying factors that motivate people to make charitable gifts: religion, social theory, political orientation, emotions, tax and economic factors, among others. Gifts are rarely motivated by just one of these elements. They typically result from the complex interaction of several of these factors, different in the case of each donor.

But it is not enough to explore why donors make gifts. It is also important to examine why people sometimes don’t make gifts they would otherwise like to complete.

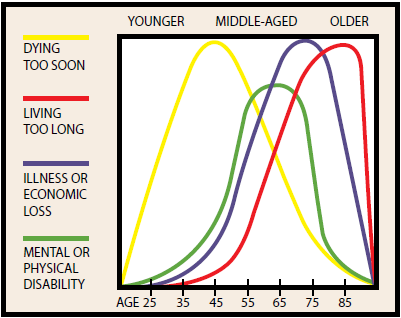

Experience shows that a number of financial fears can act as demotivators of charitable gifts. They fall into four broad areas of concern:

- dying too soon

- living too long

- unexpected illness or other economic emergency

- mental or physical disability

Successful development officers understand these fears and how various gift planning vehicles can help create solutions that allow donors to make gifts they might not otherwise think possible.

Dying too soon

Many of those who would like to make a substantial gift worry that they could pass away without fulfilling their financial responsibilities to loved ones. It seems no one is immune from these anxieties, regardless of age. Younger people may be anxious about providing for dependent children. Those in their middle years feel a responsibility to care for aging parents, and an older donor’s need to care for a surviving spouse, sibling or other loved one often eclipses the desire to make charitable gifts.

Living too long

About the time people begin to worry less about dying too soon, they can become anxious about outliving their resources, especially in times of lower interest rates and fluctuations in equity markets. Fundraisers enjoyed a reprieve from this problem when rapid economic growth and relatively high interest rates made many donors feel more secure about their retirement years. Now, however, more and more people are beginning to contemplate how they will support themselves over the long term in times of single-digit returns on both equities and income-producing investments.

Illness or economic emergency

As the cost of healthcare continues to rise and debates continue on how to fund it, the need to preserve funds for a potential illness is becoming increasingly pressing. Many also worry about the health of the economy and may be concerned about their business prospects and/or job security.

Mental or physical disability

As life expectancies increase, people of all ages realize the importance of preparing for the possibility of long-term mental or physical disability. One or more of the above concerns is at the heart of many decisions—however reluctant—to make a smaller gift than a donor would otherwise like to make. These fears do not remain constant throughout life but rather vary with age and economic capability, as seen in the chart below.

The role of gift planning

To raise significant funds in today’s environment, development officers should acknowledge and understand the concerns outlined above and determine if and how a gift planning tool can help alleviate these anxieties and fulfill a donor’s desire to give. When the donor’s best interests are kept at the forefront, the process of gift planning can provide powerful solutions to seemingly insoluble dilemmas.

There are two basic categories of gift planning vehicles that can help a motivated, but anxious, donor make a gift.

Revocable:

Many gift plans allow donors to make revocable gifts that give them the freedom to change their minds if they need to access the funds at a later date. Because their revocability precludes tax benefits, these plans are sometimes referred to as “non qualified” plans. Development officers at times refer to these plans as expectancies because from a legal standpoint no gift is completed until the end of one or more lives. The primary plans that fall into the revocable/nonqualified/ expectancy category include:

- bequests via will and living trusts

- remainders of retirement plans

- life insurance beneficiary designations

- jointly owned investments with rights of survivorship

- pay-on-death bank and other investment accounts

Irrevocable:

On the other hand, irrevocable gifts involve a commitment to the permanent transfer of one or more interests in property. Because the donor has parted with something at the time of the gift, tax benefits are often available. These gifts are sometimes referred to as “qualified” plans. And because the enjoyment of the gift is delayed to some later point in time, these gifts are sometimes referred to as deferred gifts.

Irrevocable/qualified/deferred gifts are built on the platform of an underlying trust, contract or deed. These plans include:

- gift annuities

- charitable remainder trusts

- charitable lead trusts

- life estates in real estate

The revocable and irrevocable plans described above along with more complex outright gifts are often referred to collectively as “planned gifts,” an umbrella term that actually includes both expectancies and deferred gifts.