Recently, a number of studies have been released concerning the potential impact on charitable giving resulting from the impending estate tax cuts and repeal. How will your planned giving program be affected?

Over the past several years, reports had predicted reductions of between 12% and 37% in gifts from estates, depending on economic assumptions. Based on the most recent Giving USA estimate of $21.6 billion in charitable bequests for 2003, this shortfall could amount to between $2.6 and $8.0 billion in lost gift revenue.

CBO predicts reduction

Two new studies from the Congressional Budget Office provide updated predictions that are likely to cause spirited debates among those interested in charitable gift planning. One report examines the overall impact of the pending changes on charitable giving. That report, The Estate Tax and Charitable Giving, concluded that the repeal of the estate tax would lead to a 6% to 12% reduction in total charitable giving. This could result in a $12 to $24 billion reduction in gifts from individuals and estates, based on the latest Giving USA figures. The report predicts a much smaller impact if the estate tax exemption equivalent were to be frozen at the $2 to $3.5 million level. The effect of that more limited increase in estate tax exemption was predicted to cause less than a 3% reduction in overall charitable giving.

The second study released by the Congressional Budget Office, Charitable Bequests and the Repeal of the Estate Tax, examines previous predictions of a very broad potential range in the decline of charitable bequests. The paper concludes that, with some adjustments to the methodologies used, the earlier reports were actually much closer in their conclusions. The new study concluded that the reductions were more likely to fall within a range of 20% to 30%. Again, using the latest Giving USA figures, this would put the potential reduction in bequests in the range of $4.3 to $6.5 billion.

Committee report suggests upswing

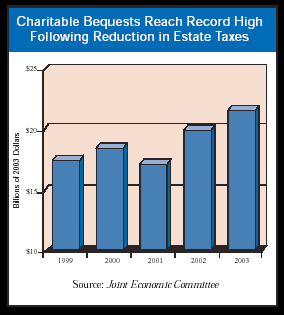

Meanwhile the Joint Economic Committee of Congress reports that charitable bequests reached a record high following the initial reductions in estate taxes. Their analysis of the data found that charitable bequests actually increased 25% over the past five years in inflation-adjusted dollars. This trend line would appear to contradict the position of the CBO’s reports.

Effect of the Economic Recovery Act

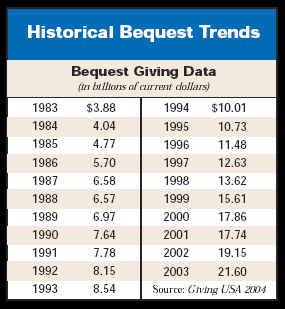

The conflict between these positions is not one that is likely to be resolved anytime soon. It may be instructive, however, to examine the general trend line of charitable bequests in the decades since the enactment of the Economic Recovery Act of 1981. This law unified gift and estate taxes, phased in the original $600,000 exemption equivalent, and provided for an unlimited marital deduction. The net effect of these changes was to exempt 96% of estates from even having to file an estate tax return. At the time there were dire predictions about the possible impact of these changes on future charitable gifts from estates. Even so, charitable bequests generally continued to grow over the period examined in the chart below.

During this period the largest estates continued to be taxable, and many of them also enjoyed the benefit of a charitable deduction. However, it should be noted that the charitable deduction only reduces the cost of the charitable gift. Unlike a tax credit, which would offset the tax levy dollar for dollar, a deduction only “saves” the amount of the tax. Thus family or other heirs will receive more if there were no charitable gift at all. For example, this year the highest estate tax is 48% and therefore the after-tax cost of the gift is 52%. Thus a $1 million charitable bequest would still deprive heirs of $520,000.

The overall effect

In theory, the elimination of the estate tax may leave more for both the decedent’s non-charitable and charitable beneficiaries.

Think of it this way: If you and your sibling were splitting a pie as an afternoon snack, your pieces would be larger than if you waited for your “Uncle Sam” from Washington to drop by and take a piece.

Most professionals would agree that tax incentives encourage certain activities. While credits may be better than deductions, all tax benefits have a role in influencing the behavior of individuals. There can be little doubt that some charitable bequests will be affected by a reduction or a repeal of the estate tax.

It is also clear that more assets will be available as the estate tax is reduced or eliminated, which in turn will leave larger slices of pie for both charitable and non-charitable beneficiaries.

In the final analysis, one must determine if the net effect of these contradictions will result in reductions or slower growth in charitable giving. If the overall economic pie continues to grow, the charitable slice will grow. If the economy suffers a sustained setback, people will continue to give but they will have less to give.

Astute gift planners will also note that even a 20% drop in charitable bequests would only put the annual dollar volume back to the 2001 level. As tax incentives are reduced or eliminated, it may be wise to focus on other donor motivations and seek to maintain relationships with those older individuals who believe in your organization and the work that it does.

The greater economic benefit from the commercial gift annuity is largely due to the fact that the amount that is designed to be left to the charity in the case of a charitable annuity (50%) is substantially more than the “residuum” built in for the insurance company, and the fact that less of the payments from the commercial annuity is taxable to the recipient because more of the payment is composed of return of a larger amount of the donors’ principal.

Effect of tax deduction

But what about the charitable deduction that is allowed in the case of a charitable gift annuity that is not available when one funds a commercial annuity? In the case above, a donor would be allowed to deduct 40% of the amount transferred for the charitable gift annuity, or $11,885. If the donor is subject to the highest federal tax bracket of 35%, this results in an income tax savings of $4,160. The after-tax cost of the gift annuity is then $25,840. If you consider the amount of the gift annuity payments as a percentage of the $25,840 after-tax “cost” of the gift annuity, the effective rate on the charitable annuity rises from 6.5% to 7.5%, much closer to the 8% paid by a comparable commercial annuity. After payment of income tax on the gift annuity amount, however, the net rate paid by the commercial annuity is 7.31% compared to 6.45% for a charitable gift annuity.

Thus, even after considering the tax benefits associated with a charitable gift annuity, a commercial gift annuity will normally provide significantly higher after-tax income than its charitable cousin.

The importance of donative intent

Experience shows that organizations who enjoy the most success with gift annuities tend to be those who market them to relatively long-term, older donors who would otherwise fit the profile of a prospective bequest donor. While gift annuities may not be the best “invest-ment” when viewed from that perspective, they may be extremely attractive when compared to a traditional bequest via one’s will.

Returning to the case of the 70-year-old donor mentioned above, consider the appeal a gift annuity might have when compared to a bequest. If the donor does not have a taxable estate, there would be no tax benefits from a charitable bequest. On the other hand, if she used $100,000 in cash that had been earning 3% to fund the gift annuity featuring largely tax-free payments twice as large, as well as a $40,000 tax deduction, she might well prefer the gift annuity. From the charity’s perspective, the gift annuity is irrevocable and may ultimately yield more charitable benefit than the bequest alternative should the donor’s assets be depleted by medical and other expenses prior to her demise.

If the donor did, in fact, have a taxable estate, the amount used to fund the gift annuity is removed from her taxable estate, just as in the case of a charitable bequest. The difference is that the donor enjoys increased income that is largely tax free and income tax savings during lifetime in addition to an eventual reduction in estate taxes.

In conclusion, a basic understanding of the economics of charitable gift annuities versus commercial annuities can be very helpful. While the financial benefits of a gift annuity can be vital when a donor is deciding how to best make a gift, there are better investments that are broadly available to persons who are only interested in the highest return on their investment dollars. For that reason, it is best to focus attention on those who have proven interest in furthering your mission, and to introduce the gift annuity as an exciting way to do more than they might have otherwise thought possible.