Gift planners have become used to slight fluctuations in the results of the charitable gift calculation process caused by monthly changes in the discount rate prescribed by law for use in calculating such deductions. In February and March, the discount rate has dropped to 6.8%, continuing a long-term decline of 30% since the rate last peaked at 9.6% in February, 1995. What does this mean for gift planners and donors?

A short history lesson

Prior to adopting a floating rate based on 120% of the so-called “Applicable Federal Mid-Term Rate,” the calculation process utilized tables based on a fixed rate. For many years that rate was 6%. As the economy changed, especially during times of high interest rates brought about by inflation and other factors, these tables often failed to reflect realistic rates of return.

In an attempt to react to the interest rate climate of the time, the fixed rate assumption was changed to 10% in the early 1980s. Before the change to 10%, there was a flurry of interest in gift planning arrangements such as the charitable lead trust, which benefited from the lower discount rate.

The subsequent adoption of the 10% tables resulted in the necessity for higher payout rates and longer payment periods for charitable lead trusts in order to result in elimination of estate and/or gift tax. As a consequence, there was less interest in the charitable lead trust. After the shift to “floating” rates in 1989, the rate subsequently floated as high as 11% in June, 1990. At this rate, a lead trust would have to specify a payment rate of 12.5 % in order to eliminate all tax on a trust with a 20-year time period. Thus, there were few “takers.”

On the other hand, since the shift to monthly floating rates, there have been periods when the interest rates fell back to the 6%-7% level, making charitable lead trusts more attractive once again. At a 6.8% level, for example, an 8.5% payout from a charitable lead annuity trust for 20 years will result in a gift or estate tax deduction equal to 99% of the amount of the gift.

Former First Lady made lead trust “fashionable”

During one such period when the discount rate was less than 7%, numerous articles and seminars were devoted to the drafted, but never funded, Jackie Onassis charitable lead trust. Excitement among non-profit gift planners and advisors alike was soon replaced by disappointment as interest rates quickly climbed, leaving donors no longer able to achieve the same results that were available to the Onassis estate. At the time of Mrs. Onassis’s death in 1994, the executors of her estate were able to select a favorable 6.4% federal mid-term rate for calculation purposes.

February brings “valentine” for gift planners

In February, 1998, the discount rate dropped to 6.8%, very close to the same percentage that was used in the Onassis lead trust example. And, the rate remains at 6.8% for March.

Interest rates could drop even lower in the coming months, which might mean that it’s time to pull out lead trust proposals that may have been “on hold” pending lower interest rates.

Consider a marketing initiative

A major university recently presented the concept of charitable lead trusts to a group of 2,000 of its wealthiest alumni. A brief newsletter format was used featuring a story describing a lead trust that had been received by the university. A hypothetical example of a $1 million gift was used as part of the piece. Within two weeks the university received over 30 requests (1.5% response) for lead trust proposals. The gift planning staff is now engaged in the exciting process of working with those who responded.

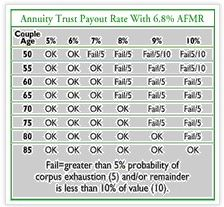

Annuity Trust Payout Rate With 6.8% AFMR

Beware the effect on other plans

It is also important to note, however, that the falling discount rate can make certain charitable remainder trusts and gift annuities somewhat less attractive. As the discount rate drops, the amount of the charitable deduction for remainder-type gifts will fall as well. More important, there is also an increased possibility that trusts for relatively young beneficiaries may fail to pass the long-standing 5% probability test and/or the new 10% minimum remainder requirement included in the Taxpayer Relief Act of 1997. (See the chart above and www.sharpenet.com for more information on these requirements.)

Conclusion

Whether discount rates continue to drop or rise in the future, keep in mind that donors will still be motivated to give out of generosity and belief in a cause. The manner in which they give can, however, be greatly affected by factors as mundane as changes in interest rates paid by the federal government.