In December of last year, the IRS issued long-awaited regulations that clarify situations in which charitable remainder trusts may be structured in the form of “flip” trusts. A flip trust is a charitable remainder trust which begins as a net income or net income with makeup unitrust and then “flips” to a straight payout trust upon the occurrence of a particular “triggering” event. See Give & Take, February 1999 for additional information regarding flip trusts and the IRS regulations.

Of particular interest to planners is the fact that the so-called triggering event that causes a net income trust to become a straight unitrust may be something other than the sale of hard to market assets. Any number of events including a specific date, a marriage, death, divorce, or birth may trigger the flip. The only restriction the IRS mentions in the regulations is that the triggering event must be one that is not in control of the donor, trustee, or other interested party.

The following example illustrates the flexibility of the new flip trust provisions and how they open opportunities for unitrusts to be used in innovative ways that were heretofore not possible.

Funding education

Charles and Martha Clore, ages 65 and 62, are interested in making a significant gift to a charitable interest to endow a long-term project. They are concerned, however, that they may need to put off making this gift for some period of time, as they promised their son that they would help educate their granddaughter Louise, who is now 12 years of age. They are also concerned that they may need all of their assets to assure a comfortable retirement because they have been self-employed and do not have significant retirement assets in the form of qualified retirement plans.

The Clores own a piece of land worth $1 million which they purchased for $100,000 as a long-term investment in the 1970s. They are paying taxes on the land each year and it is becoming somewhat of a burden. Developers make them offers frequently, but they hesitate to sell on account of a capital gains tax bill of up to $180,000 in the event of a sale.

It is suggested to them that they might want to consider a new type of charitable remainder trust known as a flip trust. In fact, they are advised to consider two such trusts.

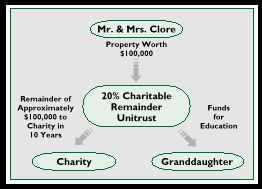

The first trust would be a 20% net income unitrust that would last for a period of 10 years. Their granddaughter Louise would be the income beneficiary of the trust. The trust would be funded with a one-tenth undivided interest in the land worth $100,000. After the sale of the land, the capital gains tax-free proceeds would be invested aggressively for a total return projected to be about 10% per year. There would presumably be a small amount of income paid out of the trust each year for Louise’s benefit which would be invested for her account. In six years, when Louise is 18 years of age, the trust would flip and become a straight payout unitrust for the remaining four years.

This trust might be depicted as follows:

The tax deduction for this trust would be 11%, just over the minimum permissible level of 10% under the terms of the 1997 tax act. If the trust earns a total return of 10% and pays out 2% before the flip, there should be approximately $160,000 in the trust at the time of the flip as a result of a net growth of 8% per year. The first year payment, which would be timed to coincide with Louise’s first year in college, would be approximately $32,000, with a gradual reduction to $23,000 in the fourth year after the flip, which is also the tenth and final year of the trust.

When the trust terminates, there should be a balance in the trust for charitable purposes of just over $100,000, despite the fact that the trust would have made payments equal to 20% of the value of the trust corpus for the final four years it was in existence. The ability to grow the corpus for a period of time before switching to relatively high payouts helps assure a generous income stream, while providing a charitable remainder approximately equal to the amount originally used to fund the trust.

The charitable remainder unitrust structured as a flip trust thus becomes an attractive new way to provide for educational expenses while making a meaningful charitable gift.

Funding retirement

The Clores’ second trust would be funded with the remaining 90% of the value of the land, or approximately $900,000, and would last for the remainder of their lives. The second trust would also be a net income trust intended to be invested for growth until a flip-triggering event occurs. The rate on this trust would be 7%. The triggering event would be the conclusion of a period of 10 years or the death of one of the Clores, whichever occurred first. At that time, the trust would begin paying the full 7% amount regardless of the net earnings of the trust. If the trust earns a total return of 10% and pays out 2% income during the growth phase, at the end of ten years, the value of the trust corpus should be approximately $1,900,000 and the Clores’ payment would be in the range of $136,000 the first year after the flip occurs. The Clores’ tax deduction in the year of the trust would be $210,000.

The property used to fund both trusts would effectively be removed from their estates, saving as much as $550,000 in estate taxes. The capital gains tax avoided would be as much as $180,000, and the income tax savings would be over $84,000 in their bracket. They are pleased with this prospect, with the fact that the property in the trust for Louise would provide what is expected to be a $100,000 gift in just 10 years, and with knowing that the property in the second trust for their benefit would also be used for charitable purposes at the death of the survivor.

Exciting new opportunities

Neither one of these trusts would have been possible prior to the December 1998 regulations. The best that might have been accomplished would have been a flip on the sale of the land. The ability to aggressively invest assets for a high total return for a period of time before making payments that may include distributions of corpus (taxed at capital gains rates in many cases) at a time chosen, but not influenced, by the donor will usher in a new era in charitable trust planning that should result in more and larger gifts due to the unexpected benefits of unusually favorable new IRS regulations