At the twenty-third Conference on Gift Annuities held in Atlanta April 14-16, the new gift annuity rates recommended by the American Council on Gift Annuities were adopted. The recommended starting date for the new rates is July 1, 1998.

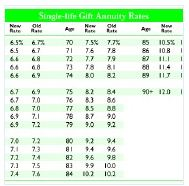

The new rates represent a slight reduction in rates for those age 83 and younger. Recommended rates remained unchanged for those age 84 and older. See the box below for a comparison of current rates to the new recommended rates.

The new rates for single-life gift annuities have been reduced by no more than .2% to .3%. Two main factors influenced the Council’s decision to lower gift annuity rates. First, the assumed rate of return for gift annuities has been reduced from 7.0% to 6.75% to accommodate charities in certain states, like New York and California, whose return may be limited by investment restrictions. The second reason given for lowering the rates for charitable gift annuities is to keep them differentiated from commercial rates to avoid any appearance of competition between charitable organizations and insurance companies.

The earnings assumptions for deferred gift annuities were reduced as well. This will result in slightly lower deferred gift annuity rates.

Surveys show that the majority of the Council sponsors routinely follow the recommended rate structure, although the rates are suggested rates only and sponsors are not required to follow them and there are no sanctions for failure to do so. With passage of the Charitable Giving Protection Act of 1995, Congress made it clear that charities may join together to recommend rates in keeping with practices of the American Council on Gift Annuities since 1927 without risk of violating federal antitrust laws.