Many Americans feel wealthier today than they have since before the Great Recession began in the fall of 2007. According to the latest data from the Federal Reserve, household net worth reached $66.1 trillion in the fourth quarter of 2012. That figure is the highest reported since the third quarter of 2007, when household net worth reached an all-time high of $67.3 trillion, and represents an increase of $5.5 trillion over the third quarter of 2012.

Some economists believe that, given the continued economic growth seen in the first quarter of 2013, house-hold wealth may now be at an all-time high.

What’s behind the growth?

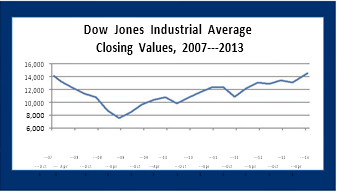

Americans can thank the rise in stock prices and real estate values for their renewed levels of wealth. After reaching a peak of over 14,100 in October 2007, the Dow Jones industrial average lost 54 percent of its value over the next 18 months. A steady increase in value led to a close just above 13,000 by Dec. 31, 2012, and greater than 14,500 by the end of the first quarter of 2013.

Real estate rising

Real estate values have risen as well. According to the Fed report, the value of household real estate increased $1.4 trillion last year, reaching a total of $17.65 trillion.

Consumer confidence has responded to the good news. One survey conducted after the first quarter of 2013 reported that 77 percent of consumers believe real estate properties will regain their pre-recession value. In fact, the average household saw a $19,000 increase in home value last year, and March marked the thirteenth consecutive national monthly increase in home prices.

Good news for gift planners

Because the rise in household net worth is attributable in large part to the stock market surge, much of the gain is concentrated among wealthy Americans, many of whom are in the prime age range for major gifts, both current and deferred.

Now may be the perfect time to inform your donors about the benefits of funding gifts with appreciated securities and other assets. By making a gift of such assets, they can avoid the capital gains tax they would otherwise owe while capturing the stock’s full market value. See the April issue of Give & Take and Page 2 for more about stock gifts.