By Robert F. Sharpe, Jr.

Age and wealth matter in fundraising.

Early last year, I introduced the term “Gerontrophilanthroplutocracy” at a number of gatherings of development professionals. The purpose of this term was to grab the attention of the attendees and open a discussion of ongoing major shifts in the philanthropic landscape, from demographic shifts to lingering impacts of the recent economic downturn.

Fundraising during the Great Recession

During the downturn, we at Sharpe Group noticed that the economic environment was impacting charitable organizations and institutions differently depending on their mission, location, size and other factors. At the time, there was widespread speculation about what was causing some organizations to experience dramatic decreases in funding while others remained steady or even enjoyed an increase.

Now that individual giving has largely recovered to pre-recession levels and data from the downturn is becoming available from the IRS and other sources, an emerging picture is providing some insight on the past, present and perhaps future of philanthropy in the U.S. IRS data yields surprising information

The Treasury Department recently released a compilation of data culled from tax returns filed by individuals in 2014. Among other things, this report categorizes amounts deducted as charitable gifts by adjusted gross income (AGI), age ranges of donors and other factors. Since roughly 80 percent of gifts by individuals are itemized on tax returns, this information provides a fairly accurate representation of charitable giving.

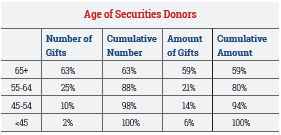

When added to similar tax deduction data released for prior years, we found that itemized giving by individuals dropped some 15 percent between 2007 and 2009 before beginning a gradual recovery to pre-recession levels by 2014. However, the decline and recovery have not been spread evenly over all age ranges.

When added to similar tax deduction data released for prior years, we found that itemized giving by individuals dropped some 15 percent between 2007 and 2009 before beginning a gradual recovery to pre-recession levels by 2014. However, the decline and recovery have not been spread evenly over all age ranges.

Giving by those under age 55 rose only 11 percent between 2009 and 2014 and had not yet fully recovered to pre-recession levels by 2014. On the other hand, giving by taxpayers age 55 and older grew by 58 percent during that time and has led the way in recovery.

Note the comparison of these two age ranges illustrated in Fig. 1.

Eldest lead the way

Eldest lead the way

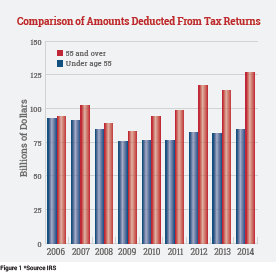

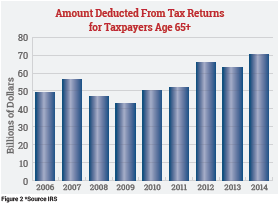

Perhaps the most surprising fact revealed by this IRS data is the dominance of the 65-and-older age group in charitable giving (See Fig 2). Some $70 billion, or 33 percent of the total donated and itemized and 25 percent of individual gifts (as reported by Giving USA), was given by those 65 and older. To underscore this fact, note that these 7.7 million donors represent just 3 percent of all Americans over the age of 21. The next closest age range was 55-64; this group donated approximately $56 billion.

Hence the term “Gerontrophilanthroplutocracy.” It is becoming increasingly evident that older Americans are leading the way in philanthropy. If it were not for them, the nation’s nonprofit community would be experiencing a much less robust recovery—if any recovery at all.

This trend may foreshadow an unprecedented growth in philanthropy in coming years as the leading edge of the Baby Boomers has now passed age 65 and the remaining members of this generation will reach this age milestone over the next 15 years.

What are they giving?

What are they giving?

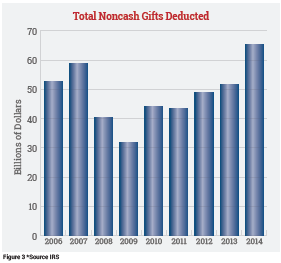

It is also instructive to look at trends in giving during the Great Recession in terms of what was (and was not) given. IRS data reveals that there was relatively little change in itemized giving of cash during the recession. There were, however, significant shifts in giving when examining gifts of noncash property. (See Fig 3.)

The collapse of investment and real estate markets during the recession accounted for a disproportionate share of the decline in giving. As the stock market has recovered in recent years, market gains have driven the recovery.

Who makes these gifts of noncash properties? Interestingly, IRS data reveals that the bulk of securities gifts are made by donors 55 and older, with nearly 60 percent coming from those 65 and over.

Giving in relation to AGI

Giving in relation to AGI

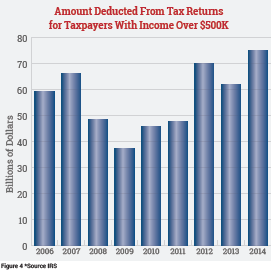

One final piece of the puzzle is tied to the donor’s AGI. IRS data shows that giving by those with incomes under $500,000 was little changed during the Great Recession. The bulk of the decline—and the recovery—can instead be traced to those with an AGI over $500,000 (See Fig. 4).

The amount of the drop in giving by taxpayers with AGIs over $500,000 is almost entirely explained by the decline in noncash gifts illustrated in Figure 3. The same is true of the recovery.

Hence, a reasonable observer could conclude that the nation’s nonprofit community will increasingly be relying on the wealthiest seniors who will be giving primarily from noncash assets. This trend appears to be a byproduct of the fact that the much discussed “1 percent” of the U.S. population is not only older than many have assumed but is also making larger gifts primarily in the form of noncash assets.

What does this mean?

With history as our guide, we can assume that the nonprofit sector will continue to be funded throughout the economic and political uncertainties that may await us in coming years.

The exigencies of age will increasingly collide with philanthropic desires as the Baby Boomers grow older. Fortunately, there are many ways that creative gift planning can help older, wealthier individuals make meaningful gifts they may have thought were beyond their capability.

For instance, charitable remainder trusts or gift annuities can help with retirement expenses or provide support to less economically secure loved ones. Charitable lead trusts can help fulfill philanthropic desires while transferring assets to the next generation and reducing or eliminating transfer taxes.

As larger numbers of Baby Boomers enter this critical stage in the donor lifecycle, development professionals will increasingly play a necessary role in helping donors balance personal and philanthropic priorities through blended gifts that meet current and future needs of both donors and the causes they wish to support.

To learn more about how to navigate coming fundraising trends, attend one of Sharpe’s highly rated seminars. Visit www.SHARPEnet.com/seminars to register. ■