The Internal Revenue Service’s Winter 2012 Statistics of Income Bulletin includes a wealth of information on the current status of charitable trusts in America.

An article entitled “Split-Interest Trusts, Filing Year 2010” examines actual informational returns submitted to the IRS. The more than 100,000 returns provide a snapshot of how charitable remainder trusts, lead trusts and pooled income funds were utilized that year.

Charitable remainder trusts were the most commonly reported split-interest trusts in 2010. Annuity and unitrusts accounted for more than 90 percent of all charitable split-interest returns filed with the IRS. The balance was divided between charitable lead trusts and pooled income funds.

The Great Recession and financial crisis contributed to a decline in the number of split-interest trust filings, which fell from 122,541 in 2009 to 118,787 in 2010.

During this period, charitable remainder trusts overall were terminated at a faster rate than new trusts were created. This trend no doubt was influenced by a significant reduction in the value of many appreciated securities, which are a favorite funding asset for charitable remainder trusts. With the Dow Jones Industrial Average now back into the 13,000 range, history reveals there may be renewed interest in funding charitable remainder trusts with appreciated or “re-appreciated” securities.

On average, charitable remainder trusts terminate approximately 15 years after creation. This corresponds to the life expectancy of persons in their mid-70s. Terms of these trusts vary according to the type of trust in question.

Charitable benefits

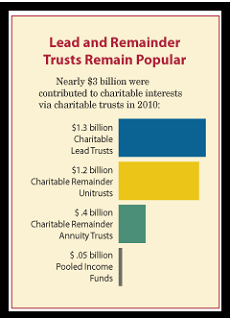

The SOI study also reports trust distributions made for charitable purposes. These distributions include payments to charities of both trust income and principal.

In 2010, almost $3 billion was distributed from charitable trusts for charitable purposes. More than $1.3 billion came from charitable lead trusts, while over $1.2 billion was distributed from charitable remainder unitrusts. Just under $400 million came from charitable remainder annuity trusts and almost $50 million from pooled income funds.

Although almost 5,000 charitable trusts in 2010 were valued at $3 million or over, the vast majority of charitable remainder trusts fell into the under-$500,000 category. More than 80,000 charitable remainder trusts were valued at under $500,000, while just over 30,000 were valued at $500,000 or more. The same trend holds true with charitable lead trusts, with some 65 percent holding less than $1 million.

The takeaway

With more than 75 percent of all charitable trusts falling into the under-$500,000 category, it would appear that the primary market for these gift planning tools is affluent individuals who might categorize themselves as members of the upper middle class instead of the ultra-high net worth category. With growing numbers of baby boomers turning 65 over the next 20 years, we may be poised for an era of exceptional growth in charitable remainder and charitable lead trusts as mature Americans make plans to meet both personal and philanthropic objectives.