The IRS recently released data summarizing much of the information included in tax returns filed for estate tax purposes in 1998. There is a wealth of information contained in these reports that is of interest to those persons responsible for encouraging bequests and similar gifts. When read in conjunction with information recently published by the National Committee on Planned Giving (NCPG) in its report entitled “Planned Giving in the United States 2000,” conclusions may be drawn that can prove helpful to those making strategic decisions regarding their planned gift development efforts.

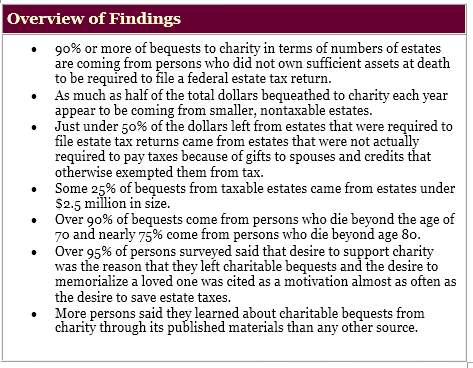

The remainder of this article will offer an analysis of data which points to the conclusions summarized in the box at right.

First things first

The U.S. Government Centers for Disease Control and Prevention tells us that some 2,337,258 people died in 1998 (see www.cdc.gov). According to a number of surveys, including the NCPG study, best estimates are that 8% of people indicate they will include charity in their estate. Studies of probate court records have found charitable bequests contained in between 8% to 12% of wills filed for probate. This would indicate that if 8% of people who die leave money to charity, then charitable bequests would have been contained in an estimated 186,980 estates from among 2,337,258 persons who died in 1998.

According to the NCPG study, some 42% of Americans have wills. Because all of the bequests from the 8% of estates leaving funds to charity must necessarily come from those who left a will or similar dispositive arrangement, about 19% of people who die with their plans in order can be expected to leave something to charity.

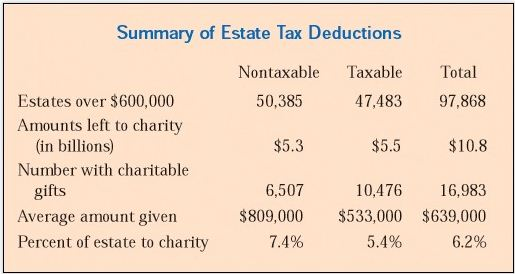

IRS data indicates that of the 2,337,258 persons who died in 1998, some 97,868 persons died with estates over $600,000 (the threshold for estate taxation in 1998) where the executor of the estate was required to file an estate tax return. That represents just 4% of the total number of persons who died in 1998. Of that number, only 47,483, some 2% of decedents, actually paid any federal estate tax, while the remaining 50,385 did not ultimately have to pay the tax, primarily due to the marital deduction and unified credit amounts that were sufficient to shelter taxes that would otherwise have been due. Of 97,868 estates over $600,000, IRS reports for 1998 reveal that a total of some 16,983 claimed charitable deductions, amounting to 17% of estate tax returns. That number appears to tie very closely to the estimate of 19% of estates leaving bequests, as derived from the NCPG study. This could lead one to the conclusion that persons who are not wealthy at the time of death appear to be about as charitable overall as persons who leave money to charity from larger estates. This may be instructive when considering the impact of the proposed reduction or elimination of federal estate and gift taxes. Continuing with our analysis, of the total estimated number of people who leave money to charity (186,980), some 91% die with estates less than $600,000, and just 16,983, or 9%, die with estates valued at more than $600,000. Thus, in terms of estate taxation, 91% of the individual bequests to charity in America are coming from estates that are not large enough to be subject to estate taxes at the levels at which they are imposed today.

Taxable estates at death

Looking at how bequests from estates over $600,000 break down by wealth and taxability of the estate is also of interest. Overall, $10.8 billion was left to charity from estates over $600,000. Recall that 51% of estates valued at over $600,000 paid no tax due to marital and other deductions, and 49% actually had to pay tax after taking all allowable deductions.

The amount of charitable bequests was split almost equally between taxable and nontaxable estates over $600,000, at $5.5 billion and $5.3 billion respectively. This is key data because it shows that half of the bequests from the wealthier Americans who die is coming from those who would not otherwise owe tax due primarily to the marital and the unified credit. Thus, in many of these cases there was actually no tax savings in the final analysis as a result of the bequests, because other deductions and credits were more than sufficient to eliminate taxes.

In terms of percentage of estates left to charity, estates over $600,000 that were not subject to tax left an average of 7.4% of assets to charity, and the estates that did have to pay tax left 5.4%. Thus, the estates that were taxed more heavily left less in terms of percentage of the estate to charity, even though bequests could have been used in virtually all cases to reduce the taxes that were otherwise due.

To further illustrate the broad-based nature of bequests at death, some $2.5 billion, or nearly 25% of the amounts left from estates over $600,000, came from nontaxable estates from persons with total assets less than $2.5 million. On the other hand, giving from the super wealthy via estates is also an important source of funds with just over 25% of the total from taxable estates coming from estates valued over $20 million.

The IRS data combined with the findings of the NCPG and other studies seems to again point to the fact that charitable activity from estates is spread across the socioeconomic spectrum with 91% of the number of estates coming from small estates not subject to tax.

Other factors at work

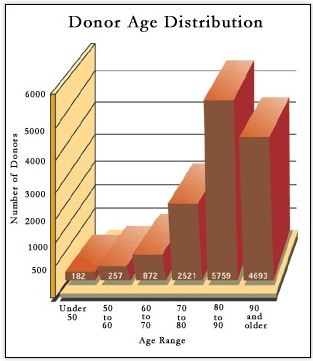

From the data summarized above, one might reasonably conclude that the desire to avoid estate tax is just one reason that people leave assets to charity at death. Experienced gift planners have learned over time that this is, in fact, the case. Charitable behavior as part of estate planning is motivated by a broad range of influences including politics, religion, emotion, and social theory, as well as economic factors such as the federal estate tax. There is other guidance in IRS estate tax return data that can prove useful when planning strategic initiatives designed to increased gifts via estates. For example, IRS data indicates that there is a strong correlation between age and charitable bequests received by charities.

In estate tax returns for 1995, female decedents passed away at 80.9 years on average, while male decedents had lived to 75.3 years. Both lived slightly longer than the general population. See the chart to the left for the breakdown of those utilizing the charitable estate tax deduction by age at time of death.

Other studies show that persons who leave assets to charity at death tend to execute the final will that leaves the assets some three to five years prior to death on average. This data would indicate the importance of emphasizing bequests and other planned giving opportunities to persons in their sixties and older.

Gender and marital status

Gender definitely affects estate giving patterns. Women are significantly more likely to include charitable provisions than men. This is for the most part explained by the fact that women tend to live longer than men. With married couples, the first spouse to die is more likely to take advantage of the unlimited marital deduction for the surviving spouse. Overall, 13.4% of male decedents left $5.1 billion and 24.3% of female decedents left charitable bequests of $5 billion. Note that while a larger percentage of women decedents leave assets to charity, the amount of funds per bequest appears to be significantly larger in the case of men.

Marital status also is an important factor to consider. Single females and males were the most likely to include charitable bequests. Almost half of all single females and over one-third of all single males included charitable provisions in their estate plans. In total numbers, widows and widowers constituted the largest source of charitable bequests.

Conclusion

The existence or lack of an estate tax no doubt influences the amount and timing of some charitable bequests. For those persons who give only for tax avoidance, they will undoubtedly reduce their charitable giving during their lifetime and via their estates if there is no estate tax. There may also be a relatively small group of art and other collectors and land owners who may choose not to make charitable dispositions if tax liquidity is no longer a factor.

On the other hand, for those with charitable motivation, whatever the source, if estate taxes are reduced or eliminated, there will be more “discretionary capital” available during their lifetime and as part of their estates. Some will choose to leave less to charity, some the same amount to charity, and early indications are that some will give more to charity during lifetime and at death, as there will be no need to “gross up” the amount left to family, and the amount that would have gone to the government can then go to family and/or charity. If tax savings at death are reduced or eliminated, more donors may also decide to take advantage of tax benefits available during lifetime through greater use of charitable remainder trusts, gift annuities, and other split interest intervivos gifts.

The recent 2000 NCPG-sponsored study findings tend to corroborate this conclusion. The study showed that 97% of persons who responded said they had made charitable provisions in their estates out of a desire to support charity. Only 35% said they did it out of a desire to reduce taxes. By comparison, some 33% said they did it to memorialize a loved one. More persons said they learned about charitable bequests from a charity through its published materials than any other source.

While it is important to understand and encourage bequests and other planned gifts among the wealthy for tax planning purposes, all indications are that the most successful programs going forward will be those that focus on the primacy of donative intent and consistently emphasize education about the importance of charitable bequests across a broad spectrum of their constituency. Such programs will be carefully designed to serve the needs of the older segment of their constituency. They will also place special emphasis on childless persons and those who may find themselves in the position of being a surviving spouse charged with the responsibility for deciding the ultimate disposition of assets that reflect a lifetime of work and devotion to the many causes that have enriched their lives and that of their spouse and other loved ones.