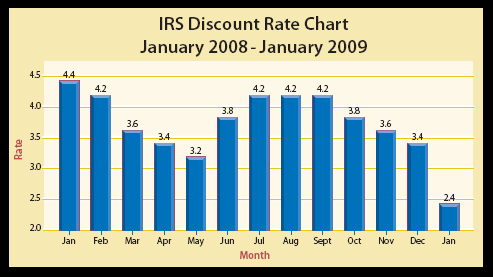

The IRS discount rate used for gift calculation purposes has fallen to an all-time low of 2.4% for January 2009. The implications of this for gift planners and potential donors are significant.

Some gift proposals currently under consideration may not qualify for a charitable deduction depending on when gifts are completed, while others will find that the amount of the charitable deduction will be reduced. On the other hand, certain gift plans will be even more attractive due to the lower AFMR and it may be wise to send revised proposals that emphasize that fact.

Review marketing materials

In some cases, marketing materials including examples and rate charts may no longer be accurate and should be revised as necessary. Charitable gift annuities and charitable remainder annuity trusts (CRATs) in particular for persons in their 50s, 60s, and 70s may fail to meet certain minimum remainder requirements and other rules, thereby creating tax issues.

For example, using a 2.4% discount rate, a 5.4% one-life charitable gift annuity for a 57-year-old and a two-life gift annuity for a 65-year-old couple both fail to generate a required 10% charitable gift portion. Likewise, it is impossible for a couple 75 and 70 to establish a 5% charitable remainder annuity trust (CRAT) because of a greater than 5% probability that the trust corpus will be exhausted. In another example, a 6% CRAT for a 75-year-old fails to pass the 5% probability test!

Remember that in January and February, donors may elect to use the discount rate from December or November. This may provide some temporary relief for gift proposals that are currently under consideration.

New rates offer solution

The American Council on Gift Annuities acted in December to lower gift annuity rates (see page 6) and thereby removed the challenges for younger gift annuitants. In order to make it possible to create charitable remainder trusts for younger persons with long life expectancies, however, Congress will have to act to lower minimum payout amounts or make other changes in the law.

In any event, it is no longer a matter for professional debate whether certain planned gifts should be marketed to younger donors than normal. It is no longer practical as tax law limitations have now been triggered.

If these lower discount rates continue into the spring, gift planners will need to adapt quickly to help donors discover alternative gift strategies that may better meet personal and philanthropic planning objectives for younger donors.

Remember that lower discount rates make charitable lead trusts and remainder interests in personal residences and farms more appealing than ever before. These gift plans may be even more attractive alternatives to major outright gifts should current economic trends continue in 2009.