Most people mistakenly “know” how you become wealthy in America. Inheritance, an advanced degree, winning the lottery, or even high income seldom are the paths to wealth. More often “wealth” in America is the result of hard work, diligent savings, and living frugally. In the book, The Millionaire Next Door (Longstreet Press, 1996), Thomas J. Stanley, Ph.D. and Will-iam D. Danko, Ph.D., explore wealth in America. The results may surprise you.

Wealth vs. income

One premise of the book is that “wealth” is not the same as “income.” Persons who enjoy high incomes but spend all of it each year are not growing wealthier. Spending equals consuming rather than accumulating wealth. Those who save, invest, and work for themselves are more likely to accumulate significant wealth.

Today, there is more personal wealth in America than ever before. Of the $22 trillion in personal wealth, nearly 50% is owned by 3.5% of our households, of which more than 25 million earn annual incomes in excess of $50,000, including more than 7 million whose incomes top $100,000; but only 3.5 million households have accumulated a net worth of $1 million.

Identifying millionaires

Things America’s millionaires have in common include:

1. living below their means

2. allocating time, energy, and money to build wealth

3. believing that financial independence is more important than displaying high social status

4. receiving no ongoing financial support from their parents

5. raising self-sufficient children

6. taking advantage of stock market opportunities, and

7. choosing the right occupation.

One startling revelation was that 80% of American millionaires were able to accumulate their wealth in one generation. Interestingly enough, the same was true more than a century ago. In The American Economy, Stanley Lebergott reviews a study conducted in 1892 of 4,047 American millionaires. He found that 84% were “nouveau riche” accumulating wealth without the benefit of an inheritance.

Most of today’s millionaires do not reach this status until they are age 50 or older. According to the authors, they would never have accumulated this amount of wealth had they lived a high-consumption lifestyle.

They are more likely to wear a Timex than a Rolex; drive a used Mercury instead of a new Mercedes; and shop at JC Penney rather than Brooks Brothers. They are seven times more likely to have a Sears card than an American Express platinum card.

Sources of wealth

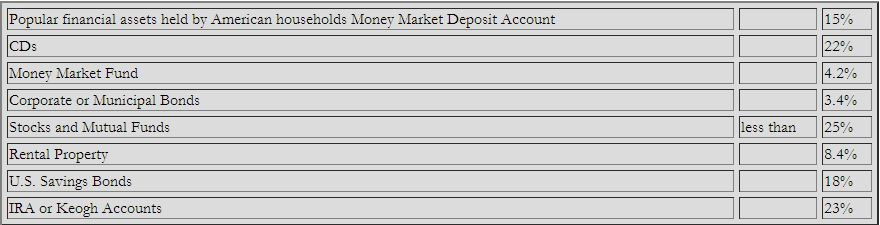

Nearly 95% of the millionaires studied own stocks and the majority have at least 20% of their wealth in publicly traded securities. The majority tend to buy and hold rather than actively trade securities. In fact, almost half made no trades whatsoever in their stock portfolio in the last year.

Applying lessons learned

The lesson for gift planners may be to learn that wealth is not always where it appears to be. Most of the so-called “high-income” earners are also high consumers, which results in little accumulated wealth. From a planned or major gift perspective, the retired schoolteacher or mail carrier with $1 million in assets usually makes a better prospect than the physician or lawyer who may own two foreign cars, two homes, two or more mortgages, and have two or more families to support.

You may want to look for prospects “next door” among your existing donors rather than from lists of persons driving expensive foreign, luxury cars. Regardless of changes in the ways that you identify prospective donors, The Millionaire Next Door presents valuable information to financial development officers or those in-terested in the “secrets” of the wealthy in America.