Americans worth $5 million or more are active contributors to charitable causes, regularly volunteer for charitable organizations, and also include charities in their estate plans, according to results of a recent report.

Conducted for Bankers Trust Private Banking by Boston College researcher Paul Schervish, the study entitled “Wealth With Responsibility Study 2000” focuses on approximately 112 households with a net worth of at least $5 million. The median net worth of those surveyed was $38 million. The report, which is a follow-up to one conducted in 1996, sheds light on the attitudes of the super-wealthy toward the relationship between philanthropy and estate planning. The report examines how much the respondents give to charity as well as how they would often like to give more.

Charitable giving habits

According to those surveyed, almost every wealthy household surveyed — 97.3% — gives to charity. Though the gift amounts varied significantly, generally the contribution amount and percentage of income contributed to charity increased in correlation with the net worth of the donors. Therefore, the higher the net worth, the larger the gifts and the greater the gifts as a percentage of income.

Most respondent families indicated that they give to causes with which they are associated as members or participants in some fashion (57%) and/or feel passionate about (72%). Not surprisingly, the report shows that gift values are higher when the donor is more involved with the organization or strongly believes in the cause.

Volunteering for charitable causes also ranked high among the respondents. Over the past three years, 92% have volunteered their time to nonprofit organizations or political causes, with 86% currently participating in volunteer activities at least one hour per month. Three quarters (75%) of those surveyed said they also spent time fundraising for charitable organizations and institutions.

When asked what factors would influence them to give more to charity, 93% of respondents reported that finding another worthy cause that they feel passionate about would make them likely to increase their charitable contributions. Eighty-eight percent said that an increase in their net worth would lead to increased giving, while 74% mentioned increased tax benefits as a reason to give more to charity.

How they would change estate plans

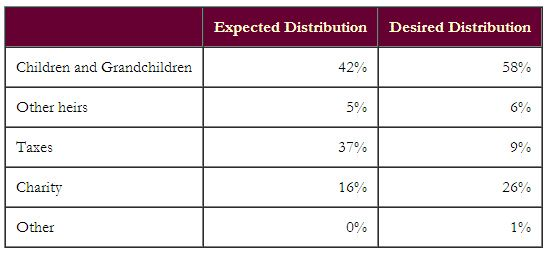

Most of the super-wealthy in the survey have a written estate plan (89%). The following chart shows how the respondents expect their assets to be distributed as well as how they would allocate their money if given total freedom to decide:

Expected and desired distribution of assets

Though not all of the respondents advocated eliminating taxes altogether, if given the opportunity, most would allocate less of their estate to taxes and distribute more money to their heirs and to charity in their estate plan. Distribution to charity would increase by 10% (a 62% increase in terms of percentage to charity) if wealth holders had their way, while children and grandchildren would receive 16% more (a 38% increase in terms of percentage).

These are very interesting findings, especially in relation to the current debate over what would happen to charitable contributions if estate taxes were reduced or repealed. The ultra-rich respondents of this survey make up the high-end segment of Americans that would be most significantly affected by elimination of the estate tax. (Click here to see the March 2001 issue of Give & Take for more on this subject.) Responses in this survey show that, unlike the predictions that estate tax repeal would quickly lead to the super-wealthy leaving everything to heirs and eliminating or drastically scaling back charitable distributions, wealth holders would likely give more to both their heirs and charitable causes. Tax relief, according to this survey, would benefit everyone named in the estate plans of the wealthy, not just heirs.

Note from the chart above that the wealthy have already achieved a “balance” between family, charity, and taxes. The charitable provisions in the estates of wealthy today are coming to some extent at the expense of heirs. When people, wealthy or not, include a charity in their estate plans, they are elevating charity to the status of a family member. If elimination of estate taxes makes more available for distribution, then one might expect distributions to increase to all participants in the estate. The Bankers Trust study seems to buttress the argument that as the “cost” to family members of charitable gifts via the estate goes down with reduced estate taxes, the “demand” for such gifts among the wealthy may, in fact, rise.

Big picture

What do these statistics of high-net-worth individuals mean for gift planners today? We should certainly be encouraged by the high percentage of those surveyed who are active in philanthropic pursuits. With tax reform under discussion, and debates surrounding the impact of change, do not assume that high-asset donors are only interested in making planned gifts or bequests to reduce their tax bill. Gift planners should not forget that donors — regardless of the level of their wealth — give for a variety or reasons.

As noted above, 93% of the wealth holders surveyed said that they would increase their charitable giving if they found a cause they felt passionate about. As you acknowledge wealthy donors who are making significant gifts, consider taking more time to discover why they are giving. Listen carefully and then take the time to try to involve them in your mission in ways that excite the passion that they say will lead them to make larger gifts. Naming opportunities, other recognition, and tax benefits are important factors, but this survey, and the experience of many veteran fundraisers, shows that the wealthy are increasingly careful and thoughtful about their giving. Those that understand that fact stand to reap substantial rewards as the coming transfer of wealth in America continues to unfold.

For more information on “Wealth With Responsibility Study 2000,” contact Bankers Trust Private Banking, 280 Park Avenue, New York, NY 10017.