A planned giving pipeline is like a gold mine. It is important to measure not only the value of what is coming out but also the value of the time and other resources being devoted to the mining process.

Nonprofit organizations measure the effectiveness of their gift planning efforts in many different ways. Some place a high value on bequests and other expectancies that have been promised but are not yet in hand, while others count only realized bequests on fundraising reports. Some do both.

Which metrics you choose will depend on many factors, including your short- and long-term fundraising goals. In some cases, where bequest income is a large component of annual income, it may be important to pay close attention to the number of new expectancies and regularly adjust cash flow projections based on the future receipt of those bequests. In other cases, where there are limited numbers of expectancies on file and bequests are realized only occasionally, it may be more practical to measure bequest results based solely on realized gifts.

Both approaches are valuable. Regardless which you adopt, make sure to build a planned giving pipeline and carefully steward those individuals who have indicated they have made a bequest to your organization. When donors of any age include a charitable interest in their estate plans, they are essentially elevating that organization to the status of a family member, and the charity should take the opportunity to strengthen those ties (see “Treat Your Donors Like Family,” July 2017 Give & Take). In the case of people in the 50-75 age range, this may involve managing relationships over a remaining life expectancy of 25 years or longer. Legacy societies are one tool that can help you keep in touch with and not lose track of these special individuals over time.

A planned giving pipeline is like a gold mine; it is therefore important to evaluate it and discover new “veins” on a regular basis. Donors who inform you of their intent to make a bequest are rare finds indeed. In most cases, only about 10-20% of realized bequests are known about in advance. That’s why it’s important to handle the donors who do alert you with thoughtful care. Take time to get to know them and their situation.

Back to basics

Think about your own donors. Knowing basic information about your constituents, especially their age, can help maximize your fundraising efforts. For instance, if you want to increase actual charitable bequest revenue over the next 10-15 years but have limited staff and budget, you should focus your marketing efforts on your oldest and most loyal constituents who are likely to make their final estate plans and then pass away in the next decade or so.

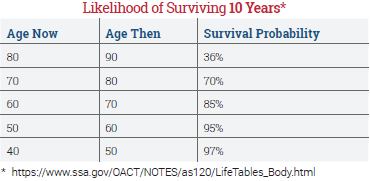

While it is impossible to know when an individual is actually going to pass away, it is possible to identify the life expectancies of population groups. Insurance annuity companies have turned that into actuarial science, as has the Social Security Administration.

Based on actuarial information, the chances of realizing a bequest in the next 10 years from a new expectancy in his or her 40s, 50s or even 60s is remote. In the near term, fundraisers are much more likely to receive a bequest gift from loyal long-term donors in their 70s, 80s and 90s.

Producing gold

We are currently entering the tail end of a period of bequest receipts from older donors, who for the most part were members of the G.I. and Silent Generations (primarily those who were born in the 1920s and ’30s). It will be 10 years or more before we begin to see bequests in large numbers being realized from Baby Boomers, who are just now turning 70.

Most bequest gifts will come from the ranks of older long-term donors who die over the age of 80. After drafting their wills or other plans in their 70s or 80s, these donors typically continue to give for a few years, then lapse before passing away. It is important to not take this group for granted. Keep in touch with them even after their giving has lapsed. Consider reaching out to them with one or more print communications per year. Research indicates that the “mature market” is likely to prefer and act on printed communications over digital or other media. Depending on the makeup of your donor constituency, occasional brochure or newsletter mailings can improve your results over time.

Drilling down

Against this background, keep in mind that an active bequest awareness program across generations can bring in all kinds of value, from retaining donors longer to discovering major donors among the ranks of younger bequest expectancy donors. Special attention, however, should be placed on older donors whose bequest expectancies are closest to being realized.

Bequests, however, are only part of the picture. In an increasingly competitive environment, your major and planned giving strategies will need to be more robust. In addition to bequests, focus on educating donors about the many ways they can make current and future gifts, such as through gift annuities, charitable trusts, charitable IRA distributions and more.

In short, pay attention to demographics when setting your gift planning fundraising goals. If marketing to potential donors is like mining for gold, make sure you are digging or panning in the right spot. Know as much as you can about your constituency, and then match the right message with the right demographic. Taking this extra step now can yield more gold in the future.

Consider using SHARPE newkirk’s Donor Data Enhancement Services to segment your donor list and help you mine for gold. For more information, click here or contact us at info@SHARPEnet.com or 901.680.5300. ■