The pooled income fund is a split-interest gift arrangement authorized by IRS Code section 642 (C) that was enacted as part of the Tax Reform Act of 1969. It is a special charitable trust maintained by a charity for the benefit of multiple contributors. Individuals or couples make gifts to the fund, which are then “pooled” and “unitized” for investment management and income distribution purposes. Each contributor receives a share of income based upon his or her pro rata share of units in the fund.

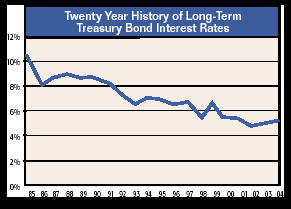

Unlike a charitable remainder trust, there is no minimum amount or percentage that the pooled income fund must pay. Pooled income funds have traditionally been invested in government bonds and other high-yield fixed-income instruments in order to maximize payouts to participants. In recent years, lower interest rates have tended to depress the payout amounts from these funds. (See chart at right illustrating trends in long-term government bond interest rates.) As a result, most charities offering this gift planning option have seen reduced enthusiasm from donors and have not actively promoted the use of this plan.

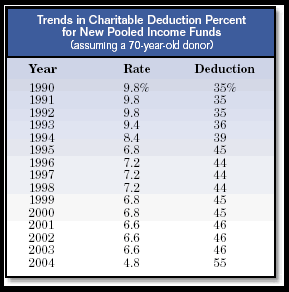

Like a charitable trust or gift annuity, however, pooled income fund donors are entitled to a charitable deduction for the calculated value of the gift portion. Because the amount of the payments is tied to the earnings of the fund, the charitable income tax deduction calculation uses the highest annual rate of return reported during the past three years for funds that have been in existence for at least that period of time. If the pooled income fund is less than three years old, a rate based on the adjusted average of the IRS discount rate over the past 36 months is used—more specifically, the annual adjusted average of the monthly discount rates, minus 1%, rounded to the nearest .2 of a percent.

For example, the adjusted averages for the past three years were 4.8% in 2001, 4.0% in 2002, and 2.8% in 2003. For pooled income funds less than three years old in 2004, the 4.8% rate would be used. The lower the assumed earning rate of the fund, the larger the allowed charitable deduction. (See chart at right, which illustrates the dramatic impact this can have on the amount of the charitable deduction available to donors.)

With the possibility of higher interest rates in coming months—as well as recent changes in the way a pooled income fund may account for income—pooled income funds may become more attractive than they have been for a number of years. For existing funds, donors may enjoy larger tax deductions based on lower earnings rates in the past. For newly created pooled income funds, donors may benefit from a low imputed rate of return based on past interest rates, which could also result in larger in-come tax deductions. Meanwhile, the actual returns and distributions from the fund may be increasing. As a result of these and other factors, now may be a good time to think about “dusting off” pooled income funds that have been dormant in recent years.