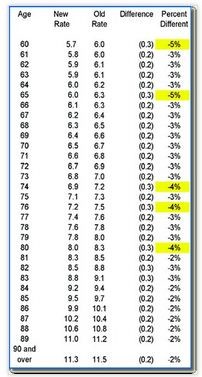

For the second time this year, the American Council on Gift Annuities has recommended that the payment rates it suggests for charitable gift annuities be reduced. The new rates, reproduced below, are effective July 1, 2003. The rate reduction varies from .2% to .5%, depending on the age of the annuitants. The new rates for persons age 60 and older are illustrated in the chart at right, with significant decreases highlighted in yellow. For complete rates, see www.acga-web.org.

Surveying the situation

Even before the new rates were announced, you may have been wondering how your gift annuity practices compare to those of other nonprofits: Do most follow the recommended rates? How many require minimum ages or contribution amounts? The American Council on Gift Annuities (ACGA) has provided answers to these questions and more in a survey conducted and released just prior to the new rate announcement.

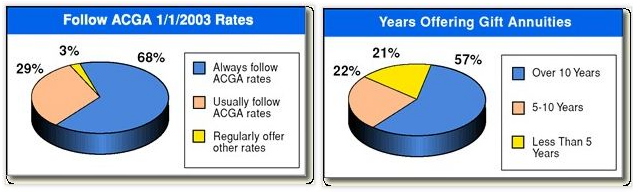

Despite the fact that issuers of gift annuities are free to set their own rates, 97% of those surveyed indicated that they always or usually follow the ACGA suggested rates. Note that charities that issue gift annuities in New York State, for example, must follow the ACGA rates unless they submit their own rates to the State with an accompanying statement from an actuary explaining the rates. For that reason, many issuers of gift annuities will not be able to extend the use of the current rates beyond June 30.

While some survey respondents expressed concern about the institutional risk associated with gift annuities, only 25% reported that their institution’s gift annuity reserve fund has declined significantly as a result of the equity and bond markets, and only 4% have had to transfer general funds to their reserve funds to meet requirements mandated by applicable regulations. The most commonly cited action designed to address concerns surrounding financial risks was raising the minimum age of annuitants.

The majority of survey participants have been issuing annuities for longer than a decade.

Less than 10% reported having more than 500 agreements in force. Almost two-thirds indicated increased activity in this area over the past three years.

More information and complete survey results are available at the ACGA’s Web site, www.acga-web.org.