Under federal income tax law and regulations, charitable remainder trusts are tax-exempt entities that are not generally liable for income or capital gain tax on the earnings of the trust — so long as the earnings stay in the trusts. Once payments are made to non-charitable beneficiaries, however, very different rules apply.

Donors, fiduciaries, and beneficiaries all share a keen interest in the way payments from charitable remainder trusts are taxed when received. The way such income is characterized is governed by what is known as the “tier structure” method of reporting income which is dictated by the Internal Revenue Code and Regulations.

The trustee of a charitable remainder trust is required to keep track of the types of income realized by the trust, even though the trust itself is not liable for tax. When payments are received by the trust beneficiary, they are reported as coming first from the highest tier possible for income tax purposes, so the income from a charitable remainder trust would generally be reported in the following order:

- Ordinary income

- Capital gain income

- Tax-free income

- Return of principal

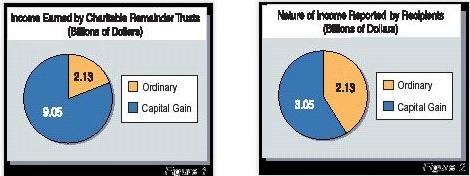

Gift planners who understand this system and its implications are better able to serve donors and their charitable interests. In today’s economic environment, it is helpful to examine the accompanying charts that are based on IRS studies of charitable remainder trust tax returns for 1998.

According to the tax return data as depicted in Figure 1, some 20% of net income reported by charitable remainder trusts fell into Tier 1, or ordinary income.

As a percentage of payments made to beneficiaries under the terms of the charitable remainder trusts, on the other hand, Tier 1 income accounted for over 40% of the income distributed in 1998 (see Figure 2). The remaining 60% of the income distribution would have been reported by recipients under the remaining three tiers, with the greatest portion being taxed as capital gain.

One could reasonably assume that as interest and dividend rates decline, less of the earnings of charitable remainder trusts will be in the form of ordinary income and a greater portion of payments will thus be taxed more favorably by recipients as capital gain income. This serves to increase the attractiveness of charitable remainder trusts, particularly annuity trusts that pay fixed amounts each year, regardless of the value of the assets in the trust.

Thus, while lower interest rates may lead to a reduction in the amount of current income tax deductions for charitable remainder trusts and gift annuities, the fact that more of the income from the trusts will be taxed at capital gains rates should not be overlooked and should increasingly be a focal point in discussions with donors and their advisors.

The foregoing is based on the IRS study, “Charitable Remainder Trusts, 1998.” See www.irs.gov.