The economic turmoil in recent months has left many savers and investors shaken. As consumer confidence erodes, so has “contributor confidence” among some prospective major donors.

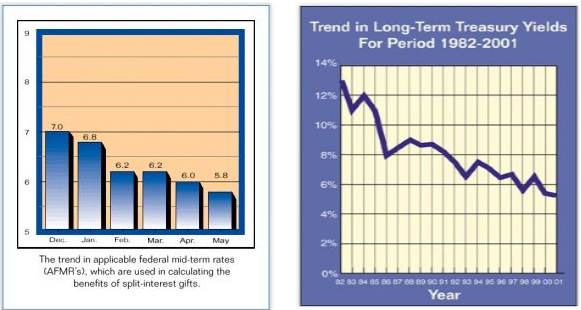

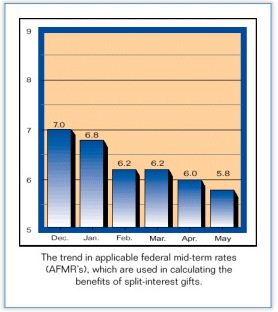

Historically, the stock market and interest rates have moved in a counter-cyclical fashion — as interest rates fell the stock market often rose and vice versa.This general trend is illustrated in Charts 1 and 2.

Recently, however, both interest rates and stock prices have been trending downward simultaneously, leaving many traditional investors and savers confused.

Chart 1 Chart 2

What to do now?

For the philanthropically inclined, now may be an ideal time to “give out of the market.” Properly planned gifts may meet both personal and philanthropic objectives. Some donors may feel as though they are “locked” in to the stock market. If they were to sell now they would incur a capital gains tax of up to 20% on the remaining gains. Other individuals may be facing declining returns on their money market accounts or certificates of deposit. Some are experiencing both of these financial dilemmas at the same time.

Gift planning options that may help individuals in these situations include the funding of charitable remainder trusts with highly appreciated, but potentially declining, assets. With a CRT, a donor can lock in a fixed or variable income based on today’s full current value of the assets to help produce cash flow for personal needs, while also fulfilling philanthropic obligations.

Charitable gift annuities are another attractive option. Consider the thousands of donors who are experiencing lower rates of return on CDs, money market and savings accounts. While yields have generally been declining over the past year, gift annuity rates have remained high and, therefore, should be increasingly appealing. Organizations and institutions with sound gift annuity programs may find that older donors may be particularly responsive to gift annuity promotions made at this time, especially in light of lower recommended gift annuity rates set to go into effect on July 1. While some may have indicated they are waiting for stock values to go back up before funding an annuity, at some point, fear of further declines may outweigh hope for recovery of losses and that is time many will move to complete their gift annuity. It is important to keep this option in front of donors to as great an extent as possible as one never knows when the “decision point” will come for a potential donor.

Additional benefits of such gifts may include current income tax savings, plus payments that may be largely taxed at rates less than other income, depending upon the circumstances.

The key for successful gift planners will be to identify arrangements that best match potential donors’ needs in light of ever changing economic conditions and personal circumstances.