In last month’s Give & Take we reviewed Giving USA’s charitable giving estimates for last year, which totaled over $200 billion for the first time in history. Charitable bequests accounted for over $16 billion of the total—another record.

This month we will examine a similar report covering charitable contributions to higher education for fiscal year 2000 as reported in the study Voluntary Support of Education (CAE) sponsored by the Council for Aid to Education (CAE). America’s colleges and universities received charitable contributions totaling $23.2 billion, a $2.8 billion increase over the prior year. This represented a 13.7% increase and was the fifth straight year that giving to higher education experienced double-digit growth. Much of the strength of giving reported was attributed to strong stock market performance during the fiscal year that included the July 1 through December 31, 1999, period when investment markets were still at record levels. It May be assumed that current economic conditions will affect the 2001 report, covering July 2000 through June 2001. Giving USA reported gifts to higher education of $28 billion for the calendar year 2000, some $5 billion (22%) more than the CAE report, indicating that there may have been an increase in giving to higher education in the second half of 2000 after the close out of CAE figures for fiscal year 2000.

A closer look

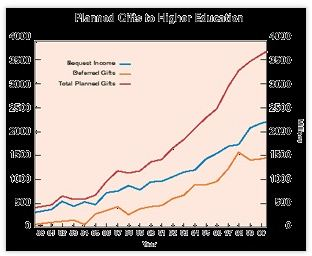

According to CAE, almost half of all gifts to higher education came from individuals or their estates. Of The $10.1 billion in gifts from individuals, $2.2 billion came from bequests and another $1.4 billion from other deferred gifts. In fact, for the past two decades, planned gifts have accounted for over one-third of all gifts from individuals to higher education.

Deferred gifts have steadily increased in importance since the Tax Reform Act of 1986, but have declined as a percentage of individual giving for the past two years while bequests as a percentage of individual giving have increased over the same time period. For the colleges and universities reporting both the face value and present value of deferred gifts, the present value of deferred gifts averaged 49% of the face value. Bequest totals were calculated based on actual bequests received, not future expectancies. See chart above.

Several factors point to the continued growth of the prospect pool for bequests and deferred gifts to colleges and universities. For example, the latest Census figures show that the over-75 age group is growing (see the August 2001 issue of Give & Take). Many colleges and universities have seen this trend as well on account of tremendous growth in class sizes in many cases following the second World War.

Press reports indicate that 1,200 World War II veterans are passing away every day, a 20% increase from just a few years ago. As bequests typically come from the estate of the second spouse to die, an increase in bequests from widows of these veterans may be expected in coming years.

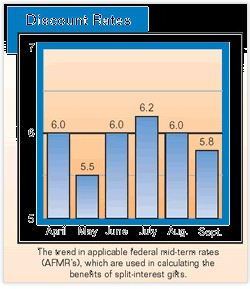

In spite of recent economic conditions, Americans continue to hold significantly more wealth today in the form of stocks, bonds, cash, and real estate than a decade ago. Many in the 65 and older age group may be concerned about the future performance of their investments and limited cash flow they produce. They also do not wish to generate taxes on capital gain, which would further reduce available cash flow. This can be expected to lead to renewed growth in deferred gifts other than bequests in coming years.

The factors outlined above, and others, bode well for nonprofits outside the field of higher education as the same trend should lead to increases in planned gifts for these organizations and institutions as well.