Under federal tax law, an interest rate factor that can change on a monthly basis must be used when calculating the tax benefits of various types of gifts. This rate information is available from software vendors and financial publications such as The Wall Street Journal, and is sometimes referred to as the “Section 7520 Rate” or applicable federal mid-term rate (AFMR).

With rapid interest rate swings in recent months, the AFMR has taken on greater importance as a planning consideration. As recently as last February, for example, donors could use a 5.4% AFMR if they desired. In March the AFMR was 8.2%, an increase of more than 50% in just over a year.

The impact on gifts

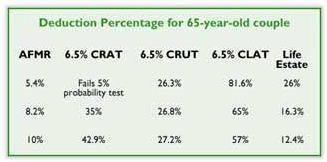

The affect on the tax benefits on charitable gifts of AFMR fluctuation over time is illustrated in the table above which shows how different rates affect a number of gift planning vehicles.

In the chart above, assuming a 5.4% AFMR, the hypothetical 65-year-old couple would have enjoyed a gift and estate tax deduction equal to over 80% of the value of assets placed in a 6.5% charitable lead annuity trust.

Note that when the AFMR increases to 10%, the gift and estate tax deduction for the same lead trust would be cut by almost one-third. Meanwhile, a 6.5% charitable remainder annuity trust would generate an income tax deduction of almost 43% of the amount used to fund the trust, whereas the same trust would fail to qualify at all with a 5.4% AFMR, because it would not pass the 5% probability test!

What to do?

Depending on what donors are trying to accomplish, astute gift development professionals should carefully match gift plans with those persons who meet the profile for such gifts at times when interest rate fluctuations make a particular plan attractive. Today, for example, that might mean identifying older persons who have traditionally gravitated toward charitable gift annuities and annuity trusts that offer more attractive benefits in times of relatively higher interest rates.

As an aside, if your program is crediting gifts in campaigns or in ongoing development efforts based on the charitable deduction allowed for such gifts, consider the fact that interest rate fluctuations can have a real impact on the results reported for planned gift development efforts. For this reason, some programs are now beginning to consider other means to evaluate their efforts that are less reliant on large swings in interest rates over relatively short time periods. This can lead to better reporting of program results and in more equity when dealing with donors who may be credited with very different amounts in the same twelve-month period for the same gift due to interest rate fluctuations.