At the 24th conference of the American Council on Gift Annuities held in April in St. Louis, it was announced that there would be no change in the recommended gift annuity rates at this time.

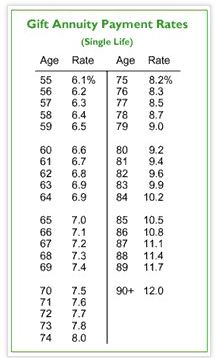

The board of the Council met and determined that the current rates continue to be prudent in light of today’s fixed income and equity markets. The rates assume a total return of 6.75% on annuity reserves with 75% cost factor with a net return of 6%. The board continues to be confident with those assumptions. The majority of charitable organizations and institutions offering gift annuities tend to utilize the Council ’s recommended rates (see rate chart to right).

New survey released

At the conference the Council also released the findings of a report entitled “1999 Survey of Charitable Gift Annuities.” The project was conducted by Frank Minton and was partially funded by the Lilly Endowment. The report noted a large increase in the number of charities offering gift annuities. The average age of gift annuity donors remained at 77 and females comprised 60% of the contracts. Approximately two-thirds were one-life gift annuity agreements and the average size has grown from slightly less than $20,000 to slightly more than $30,000 per contract.

Emphasize gift annuity’s stability

Now may be an excellent time to emphasize the benefits of gift annuities to donors who meet the profile for this gift vehicle. With market fluctuations, the gift annuity offers a wonderful opportunity for donors to make a gift while increasing income from low-yielding, highly appreciated assets. Older donors, possibly worrying about the ups and downs of the market, may be particularly interested in attractive fixed gift rates for life. Other benefits include an immediate income tax deduction, removal of assets from the taxable estate in most cases, and receipt of a portion of the annuity payments tax-free or at more favorable capital gains tax rates.

For additional information or to order a copy of the “1999 Survey of Charitable Gift Annuities,” contact the American Council on Gift Annuities, 233 McCrea Street, Suite 400, Indianapolis, IN 46225 or call (317) 269-6271.