The past year has been one of extraordinary change. We have witnessed a bubble bursting in the housing market, a meltdown in the financial markets, subprime loan losses, increases in unemployment, a credit crunch, increased stock market volatility, and a variety of other economic woes.

In spite of these events, there are indicators that giving in America held steady or even increased in 2007. Recently released figures from the Council for Aid to Education (CAE) reveal, for example, that giving to higher education actually grew by 6.3% in 2007. (See www.CAE.org)

Gaining perspective

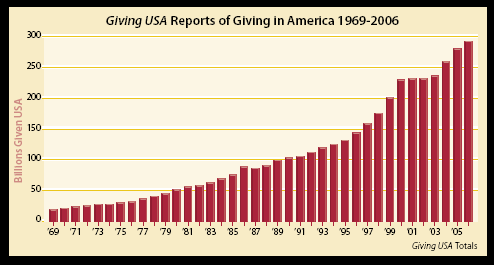

The past 20 years have been among the best ever for charitable giving. (See the chart below.)

We have to look back a number of years to find an environment comparable to today’s. Certainly the period following the 1987 stock market crash was challenging. Investment markets lost over 25% of their value in a matter of days in October of that year, and trading was suspended on stock exchanges in the midst of the busy year-end giving season. Nevertheless, overall giving dropped just 1.3% in 1987, the only decline in overall giving posted since 1969.

The recession of the early 1990s ushered in another period of difficulty. Despite that downturn in the business cycle, there was little impact on charitable giving.

To find a period more similar to the one we face today, it may be helpful to look to the mid-1970s. At that time, America was emerging from a long-term conflict in Vietnam, and the Watergate scandal was unfolding.

The economy was mired in “stagflation” as the effects of increases in oil prices in the wake of the 1973 oil embargo crippled the economy. The “energy crisis” grew while Americans shivered through cold winters and waited in long lines to purchase gasoline. Inflation picked up steam and was beginning to take a serious toll on the life savings of many. By December 1974, after adjusting for inflation, the Dow had fallen nearly 60% from its 1965 peak value.

Fund raising was indeed a challenge at that time, but giving in America still grew 1.1% in 1974 despite the dismal conditions of the period.

Real wealth remains

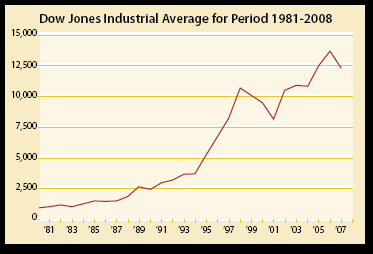

It is helpful to focus on the fact that the long-term trend in investment values has been up, and those who have regularly invested over the years have still experienced significant increases in their wealth. (See chart below.)

A person who invested in a Dow index fund in 1996 still enjoys a 100% appreciation over the ensuing time period. A $1 million investment in the Dow in 1987 is still worth nearly $5 million. Net household wealth in the United States reached an all-time high in 2007, and the number of millionaire households exceeded nine million.

Capability to give

What this adds up to is this: many Americans still possess significant amounts of wealth, and the most committed donors may be among that group.

Government studies reveal that many of the wealthiest per capita households in America are headed by persons age 65 and older—a key group from a fund development perspective.

The good news is that this age group may actually have suffered the least during the current economic downturn. They are already retired in most cases, so they do not have to worry about losing their jobs. They are not commuting every day, and are thus not experiencing the full impact of increased energy prices.

Older individuals do not tend to invest in highly speculative investments, and their portfolios typically contain higher percentages of bonds, cash, or cash equivalents. Many in this group are also just beginning to take required minimum distributions from retirement plans, further increasing their discretionary (and donatable) income.

Lower interest rates in recent months may actually increase the value of bonds, and donors who have moved into intermediate-term CDs and other relatively longer-term investments in recent years may bypass the immediate impact of lower interest rates on their income.

Facing reality

What is called for now is a realistic and sober approach to the realities confronting us. Funding methods that worked well for the entire careers of some fundraisers may no longer be as effective. Extravagant events could increasingly be considered wasteful and in bad taste. Campaigns based on selling social recognition to those seeking to make a “statement” with their newfound wealth may no longer be practical.

On the other hand, the past reveals that funding strategies rooted in helping committed persons support causes they believe in will continue to prosper.

Here are some steps we can all take today to help assure the best possible results for the remainder of this year and beyond:

- Strive to devote as much time to thanking donors for gifts as you do asking for gifts. To find the people who still have the resources to make gifts, turn your attention to those who just made them! They have just proven they have the resources to give in today’s environment.

- Take care to serve those who have given consistently over the years. In difficult times, your long-term donors will be those most likely to stay the course.

- Help donors understand how best to make their gifts today. For example, many donors now have large cash reserves after selling investments that were not performing well. Their natural inclination may be to make gifts using a portion of that cash. It might be better to give securities in which they still have gains and use their cash to purchase the same or different investments, thereby diversifying their portfolio and/or enjoying a new, higher cost basis.

- Focus on older donors. As noted above, donors in the sixty-and older age group are among the wealthiest generation in history. They may also have suffered fewer losses as their homes may have already been sold at peak values, and they may have less exposure in higher-risk stock market investments.

- Be flexible on the timing of gifts. Remember that making a gift through a gift annuity, trust arrangement, or provision in their will can be possible for a donor even if they cannot make a large gift today. Those who have remembered you in their estate plans may be your best major gift prospects when times of prosperity return.

- Look to the past for direction. If you are new to your role, seek out someone who worked in fund development for decades and has been successful over the long-term and take them to lunch.

- Resolve to not just work around the challenges, but to work “above the circumstances” that present you with difficulties. Now is the time when proven leaders once again will excel and a new generation of managers will be tested.

These are not the best of times, nor are they the worst. History reveals that charitable giving is likely to continue—and perhaps even grow—in the current environment. That is because much of the remaining wealth is in the hands of those who did not buy into the “easy money” ethos of recent years. It is owned in many cases by those who understand the true nature of wealth—and respect it enough to guard and preserve it.

The truly philanthropic have always been found among the ranks of such persons, and it remains a rewarding and noble vocation to serve them as they continue to provide much of the funding required to build and maintain our social infrastructure.

Editor’s note: This article is an update of a series of commentaries that Sharpe has published on the state of the economy and its impact on charitable giving.