By Professor Christopher P. Woehrle, JD, LLM

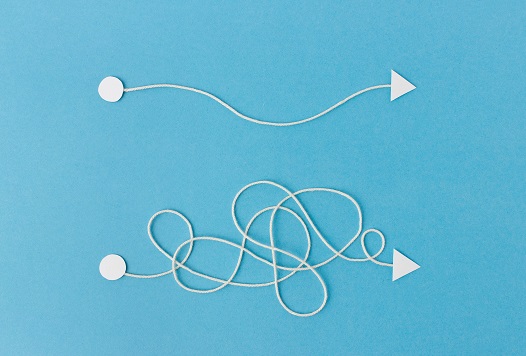

The spirit of Occam’s razor1 should drive gift options which benefit both charity and the donor. To relate to the context of gift planning, the complexity of a gift should not be increased without necessity driven by donor needs.

Over the years I have noted how development professionals can become enamored with the complexities of various split-interest gifts to the detriment of a supporter and the charity. While it is true a charitable remainder trust can be constructed in very complex ways to manage the commencement and the taxation of payments, the presentations of various options often paralyze a potential donor in deciding. A charitable lead trust can be an excellent way to transfer wealth in the most efficient transfer tax way possible, but only the tiniest slice of an organization’s donor base should be presented with it.

Simpler lifetime gifts often are just as efficient without the complexity. Some gifts are not even part of the gift transfer tax base, such as direct payments to medical care and education providers. And while, for most donors, the ultimate gift of property will be a bequest intention, never assume a donor [or even nondonor] of a “certain age” is either unable or unwilling to make outright gifts.

Evidence of simplicity’s appeal to generous donors to major institutions

A sampling of our country’s most prolific development programs at private universities suggests “simple” trumps the complex split-interest gifts. A Sharpe Group study reported that matured bequests represent the predominant percentage. The median percentage of bequests as percentage of all deferred gifts was 83 with a high of 97 and a low of 56.2.

Importance of discovering bequest intentions The same Sharpe Group study noted that a known bequest intention is likely to be greater than one that is unknown.2 The ability to thank a supporter can “cement” the relationship to the institution, minimizing the risk of a revoked intention or assuming the stewardship of a future gift with a purpose that might not be effortlessly fulfilled. The act of identifying and stewarding bequest intention donors should never be paused; rather, ideally, it should be increased as a constituency’s base merits. During 2020, Sharpe Group looks forward to sharing the latest technological and analytical tools for this identification.

Understanding what drives donor motivation

In my charitable gift planning course in the LLM program at Villanova Law, my students are often surprised to learn income and/or transfer tax considerations are not the primary appeal. Anyone who works with donors as either a development professional or an experienced financial or legal advisor is not surprised by this.

Donors want to support missions or accomplish specific philanthropic goals. The “tax savings” are identical for all publicly supported charities. An in-person visit or a virtual one via Zoom is often the best way to unearth the donor’s philanthropic goals. But remember, many bequest donors most often self-identify through a mailing. So, a combination of personal outreach and broad outreach are needed. ■

Christopher P. Woehrle is Professor and Chair of the Tax & Estate Planning Department at the College for Financial Planning in Centennial, Colorado. As one of Sharpe Group’s technical advisors, Chris is a frequent contributor to Give & Take and authors Sharpe Group blogs.

Christopher P. Woehrle is Professor and Chair of the Tax & Estate Planning Department at the College for Financial Planning in Centennial, Colorado. As one of Sharpe Group’s technical advisors, Chris is a frequent contributor to Give & Take and authors Sharpe Group blogs.

Endnotes

1. Occam’s razor, or Ockham’s razor, is a philosophical principle that simplicity, rather than multiple options, is preferable.

2. Sharpe Group Gift Planning Seminar: An Introduction to Planned Giving: Gift Planning Toolbox, Part One.