For decades, Sharpe Group consultants have analyzed large numbers of clients’ decedent estate files to help identify factors that may influence the likelihood of a charitable bequest. Experience has shown that gender, marital status, wealth, personal values, and other factors can all affect the propensity to make charitable bequests.

In addition to client data, Sharpe has examined federal estate tax return data, which has long been one of the best sources of information about the general characteristics of persons who may be inclined to include provisions for charitable purposes in their estate plans.

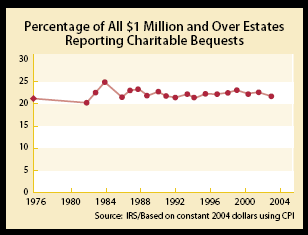

The enactment of the Economic Growth and Tax Relief Reconciliation Act of 2001 has resulted in a steady reduction in the number of estate tax returns being filed. The law called for phasing in larger estate exemption equivalents over time. In 2002, the exemption amount rose from $675,000 to $1 million. In 2004 the filing threshold rose to $1.5 million before increasing to the current $2 million in 2006. Next year it is scheduled to increase to $3.5 million. As the filing threshold increases, the number of estate tax returns filed tends to decrease and the amount of data available concerning charitable bequests from this source is consequently reduced. Given that fact, it is more important than ever that we examine the information to be gained from this source before the volume decreases even further.

Historically, about 18% on average of all federal estate tax returns include charitable provisions. This has remained true even though the actual number of returns to be filed is decreasing. Combining the data from multiple years and examining a larger pool of returns helps reveal trends that may not be evident in data for a single year.

Scope of study

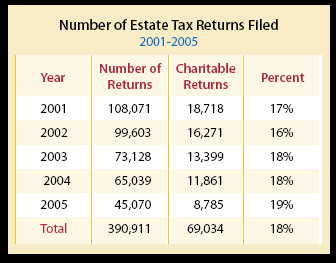

The primary focus of this Sharpe National Bequest Study is the period from 2001 to 2005. The number of estate tax returns for each year is shown on the chart below.

During this period, the number of estate tax returns fell by almost 60%. It is interesting to note that the estate tax liability continued to run between $21.7 billion and $23.5 billion in the same period, a figure close to the amount estimated for total charitable bequests during that time. In 2005, charitable bequests totaled $23.4 billion according to Giving USA estimates.

A closer look at the approximately 69,000 charitable federal estate tax returns between 2001 and 2005 may provide some additional “hard” information about the demographics of actual bequest donors from among the ranks of the well-to-do, as opposed to suspects, prospects, or even expectancies.

Does age matter?

Remarkable as it may seem, there has recently been considerable discussion about whether age is really a factor in planned giving. Some studies have reported that younger persons in their 40s or 50s are more likely to consider including charities in their estate plans than older persons.

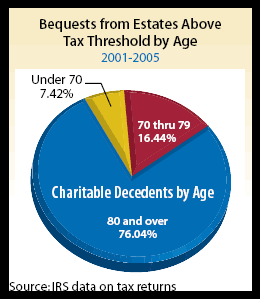

Based on the more than 69,000 estate tax returns that included charitable dispositions, a very distinct pattern emerges. Over the five-year period studied, there were only 343 charitable estates from persons dying under the age of 50. That amounts to less than ½ of one percent of the charitable estates. Less than 3% of bequests came from people who died in their 50s, and 5% from those who died in their in their 60s.

These results are in line with previous Sharpe studies of federal estate tax returns and client files over the past 45 years. These findings do not contradict studies which conclude that younger people will consider including charities in their estate plans, but rather are a reflection of mortality experience in the United States.

Nationally, most of the population lives to see at least their 80th birthday. According to U.S. federal government statistics, of every 100,000 live births, 75% survive to age 70 or older. Almost 20% will survive to age 90. Suffice it to say that age appears to be a significant factor to consider. Given the fact that other studies continually show that most bequests come from wills completed from two to five years prior to death, it becomes clear that the key to influencing bequests that will be realized in 10 years or less is to focus efforts primarily on donors over the age of 70.

What about gender and other factors?

While the dollars generated by charitable bequests were relatively evenly divided between women and men, women accounted for the vast majority of charitable bequests received from estates where tax returns were filed. In fact, women accounted for almost 60% of the number of charitable estates. Of the 69,034 charitable decedents, 40,709 were female and 28,325 were male. The average amount left by men for charitable purposes was larger, at just over $1 million per estate, while the average amount left by women was just under $640,000.

Other factors to consider include marital status, presence of children, grandchildren, or other dependents, wealth, and the prevailing tax picture. Those who were single with no children were most likely to leave money to charity. Not surprisingly, those married with children were least likely to include a charitable bequest and, when they did so, they generally left smaller dollar amounts. Inclusion of bequests to charity also increased with a person’s wealth, with those worth $20 million or more being the most likely to make a charitable bequest.

Can you use this information?

Ultimately, this may be more of a cost benefit, or return on investment, question, instead of a question of right or wrong. The answer may not be to ignore younger to middle-aged donors, but rather to appropriately allocate your time and other resources. While it is certainly important to occasionally sweep the mass of your file for bequest donors and prospects, you should invest most of your efforts in developing and maintaining planned giving relationships with donors whose gift will actually benefit your cause in the relatively near future. Plan your activities to first encourage gifts that are statistically more likely to occur sooner rather than later. Low key, inexpensive marketing such as ads, articles, and web sites can be used to search the broadest possible audiences. Additional layers of targeted marketing may be added based on a combination of factors including age, gender, marital status, wealth, and other factors.