Since 1927, the American Council on Gift Annuities has periodically published suggested gift annuity rates. Traditionally, the Council has retained the services of an actuary to review the fiscal soundness of suggested gift annuity rates every 3 years. Adjustments, when deemed necessary, have usually been made at those intervals.

Recent history

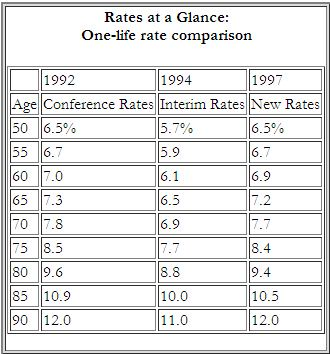

Following that pattern the last rate change announced in conjunction with a triennial conference was in 1992. Then due to significant drops in interest rates, interim action was taken in the Fall of 1993 suggesting generally lower rates. Many charities adopted and used the interim rates beginning in 1994.

Late last year, the Council board authorized its executive committee to study the existing rate recommendations and underlying actuarial assumptions and make recommendations for rates in keeping with any suggested changes in those assumptions.

New rates recommended

In early January of this year, new recommended rates were announced with a suggested effective date of March 1, 1997.

There were a number of changes in the underlying assumptions used to arrive at the revised gift annuity rate structure. They include the adoption of new, more conservative mortality tables; a change in the expense factor from a front-end load of 5% to an ongoing annual expense of .75%; and an increase in the underlying earnings assumption to a total return of 7% for regular gift annuities and 6.75% for deferred gift annuities (6.25% and 6.0% respectively after allowing for the .75% annual expense factor). This represents an increase from the previous assumption of 5.5% for regular gift annuities and from 4.0 to 5.5% for deferred gift annuities depending on the anticipated deferral period. After factoring in all of these changes, the actual suggested rates announced for annuitants for both single- and two-life gift annuities increased within a relatively narrow range from .5% to 1%.

New rates similar to 1992 rates

The 1997 rates, while somewhat higher than the 1994 rates, are generally the same or lower than the 1992 rates.

A closer look

Although the recommended rates suggest increases across the board, the increases are highest for the youngest and oldest gift annuitants. While this tends to make gift annuities more attractive to a younger audience from a payment standpoint, an examination of the value of the charitable deduction at various ages may prove interesting.

A look at tax consequences

The newly recommended gift annuity rates for younger individuals may actually provide a smaller “gift” for tax purposes (and perhaps gift reporting guidelines and under internal accounting and FASB rules) than a contract with older persons who receive much higher payout rates. .

In the past, many organizations and institutions have decided to offer gift annuities only to a selected group of donors drawn from the ranks of their relatively older constituency in order to assure the greatest expected total value of their gift annuity commitments.

As the Council rates are merely suggested rates based on the published assumptions, each organization is free to decide whether and to whom to offer the suggested rates, or to develop their own rates. Keep in mind, however, that a number of states incorporate the Council rates “by reference” in various ways in their regulatory structures, so seek counsel before adopting an independently determined rate structure if you are affected by such state regulation. In some states, adopting your own rates may require your organization to hire an independent actuary to vouch for the soundness of your rate structure. Since March 1 has been recommended as the start date for using the new rates, those that offer gift annuities might wish to take time now to analyze their individual programs for mortality experience, earnings assumptions, and cost factors to determine whether or nor adopting the suggested rates meets their program needs.