In recent months, discussions of tax reduction legislation and the Dow Jones Industrial Average continuing to hover at record levels have created unique gift opportunities for gift planners and donors.

In May of this year, the Dow eclipsed the 10,000 mark and has risen even higher in recent months. With the dramatic increase in investment markets, many of your donors likely own securities that have greatly increased in value. As a result, now may be an excellent time to examine your donor records to identify those who may be interested in major current gifts and/or life income gifts before the close of 1999.

Act now

No one can predict how long the market will continue to trade at current levels. In addition, if tax rates are reduced in the future, that could mean charitable gifts made this year will offer more favorable tax benefits than those made in coming years.

Individuals who enjoy giving to charitable organizations and institutions may find that making a gift of appreciated securities can enhance their overall financial situation. Those donors who give before December 31, 1999 can take advantage of giving securities that have greatly appreciated in recent months and enjoy the knowledge that their deductions may never be “worth” more to them than on their 1999 tax returns.

Cases to consider

Here are two examples that illustrate the benefits to donors who may be considering a current or deferred gift of securities at year-end:

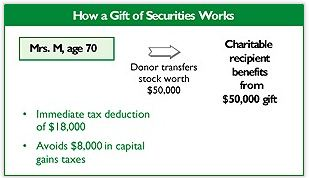

1. Mrs. M, age 70, bought 100 shares of XYZ Corporation stock ten years ago for $10,000. The fair market value of her shares has risen to $50,000 and the paper profit is $40,000.

If Mrs. M sells the stock and gives the proceeds to your organization, she will be exposed to a capital gains tax liability of approximately $8,000, based on a 20% capital gains tax rate. If she transfers the stock directly to your organization, she makes the same $50,000 gift and avoids the capital gains tax altogether.

Mrs. M will thus enjoy tax savings of $18,000 (based on a $50,000 charitable gift for an individual in the 36% income bracket) plus $8,000 in capital gains tax savings, all for an original investment of $10,000. (See the chart below.)

2. Suppose Mrs. M has recently retired and feels that it just is not possible for her to make an outright gift of $50,000 at this time. She may be interested in one or more life income gift arrangements.

In this case, Mrs. M can transfer the XYZ stock or other appreciated securities to your organization through a charitable remainder trust, pooled income fund, or charitable gift annuity. In the case of a gift annuity funded with her $50,000 in XYZ securities, for example, she would receive fixed payments of 7.5% for life. Half of her payments will be received free of tax or taxed at a favorable capital gains tax rate for a number of years. She will also enjoy an immediate income tax deduction of just under $20,000.