With all the talk about how lower discount rates encourage the creation of charitable lead trusts and create more demand for gift annuities among donors have seen their incomes shrink, many have overlooked another gift opportunity that presents itself in times of lower interest rates.

Gifts of remainder interests in homes can be especially attractive in today’s environment. That is because the value of the retained interest to the donor is calculated based on the adjusted applicable federal mid-term rate (AFMR) that has been as low as 2% for February 2009. That rate can be used through April of this year.

How does it work?

To give a remainder interest, a donor simply deeds property to a qualified charitable recipient and retains the right to the full use and enjoyment of the property for a period of time, usually for the lifetime of one or more persons. At the end of the period of the retained interest, the property is immediately owned by the charity. The donor continues to be responsible for all maintenance, taxes, and other expenses for the period they continue to enjoy its use.

For example…

Let’s look at how a couple might make use of this plan to fund a gift to a capital campaign over a five-year period:

Mr. and Mrs. Donor, both age 60, plan to retire to Florida when they are 65. They own a primary residence and a vacation home recently appraised at $595,000. They would like to continue to use the home on weekends and holidays until they retire, when they plan to sell both homes.

The Donors have been asked to consider a gift to a campaign in the range of $500,000. While they believe they may be able to afford a gift of this amount, they want to make sure they do so in a way that has the least impact on their nearterm economic security. They are also concerned about possible tax increases and would like to make a gift that maximizes their tax benefits.

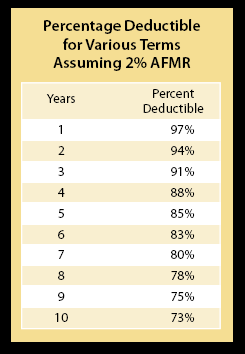

It was suggested they consider making a gift of their vacation home while retaining the right to use the property for five years. Because of lower prevailing interest rates, the IRS values the right to use the property at a relatively low amount In this case the donors would be entitled to an immediate income tax deduction of $508,000. The home would also be removed from their taxable estate, saving over $250,000 in federal estate tax their heirs could otherwise be forced to pay to inherit an illiquid asset.

At the end of five years, when the donors move to Florida, the charity will own the home and can sell it at the time the campaign will be coming to an end. The campaign guidelines give full credit for gifts completed within the five-year time frame of the campaign, so this gift would qualify for full credit for the estimated value of the property at the end of the campaign.

Gifts of remainder interests require a qualified appraisal and would need to be cleared for any environmental issues. An agreement should be entered into making it clear that the donors are responsible for all taxes, upkeep, repairs, etc. while they retain the right to enjoy the property.

While gifts for a term of years can be a good alternative to an outright gift to fund a pledge (see chart above), this type of gift can be especially attractive to older persons who are considering a large bequest. The gift of the remainder interest in a primary or secondary residence can be a way to “accelerate” a bequest while enjoying current tax benefits as well as any estate tax savings that might come as a result of a bequest.

Editor’s note: This material is excerpted from the popular Sharpe seminar “Planning Major Gifts.” See www.sharpenet.com/seminars for more information.