When President Biden signed the Consolidated

Appropriations Act, 2023 into law on Dec. 29, 2022, most

nonprofit organizations were laser-focused on year-end

giving. Now with a new year underway, many are taking a

closer look at the details and how the changes can impact

their fundraising.

Contained in the legislation was the Secure Act 2.0, intended to promote and increase retirement savings for future generations of Americans. This section of the legislation addressed issues concerning age regulations and inflation on qualified charitable distributions (QCDs) and included:

- Age changes for required minimum distributions (RMDs). The Secure Act 2.0 raised the age for RMDs to age 73. For those born in 1960 or later, their RMD will begin at age 75.

- A QCD inflation adjustment. Beginning in 2024, there will be a yearly increase (indexed for inflation) in the annual limit for QCDs.

The legislation also contained a provision to expand allowable QCDs from individual retirement accounts (IRAs). Since 2006, donors 70½ or older have been able to make tax-free gifts of up to $100,000 per year, $200,000 for a couple, from their IRAs to a public charity. After years of lobbying, QCDs can now be used to fund charitable remainder trusts (CRTs) and charitable gift annuities (CGAs), though with restrictions. There continue to be more questions than answers regarding these life income

gifts. Here is what we know:

- “One and Done”–QCDs used to fund life income plans are limited to $50,000 per individual and are a onetime election.

- Payments can only be made to the participant, spouse or both.

- The gift vehicle you choose can have no other contributions, and contributions cannot be added to

an existing CRT. - The minimum payment rate for a CGA is 5%.

- Payments must begin within one year of the gift.

- The gift vehicle is not assignable to the issuing or remainder charity.

- The $50,000 counts against a donor’s annual QCD limit in the year the gift is made.

- Spouses can each contribute up to $50,000 from their separate IRAs to fund one CGA or CRT.

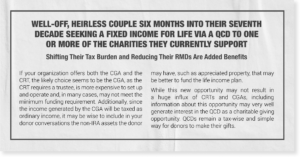

Regardless of any ambiguity regarding the legislation, it is still important to design a marketing strategy for this new giving option. Keeping all these nuances in mind, who are your ideal candidates for this opportunity? Take a look below.

Julie Schuldner, MBA, CFRE, is a Sharpe Group senior consultant with experience in nonprofit leadership and fundraising. She is based in Wilmington, North Carolina.

Julie Schuldner, MBA, CFRE, is a Sharpe Group senior consultant with experience in nonprofit leadership and fundraising. She is based in Wilmington, North Carolina.