Year-end giving may receive an unexpected boost from this year’s presidential election. Regardless of one’s personal party affiliation or preference, the stock market tends to rise in election years.

A rising stock market usually benefits charitable giving in two ways. First, there is a psychological boost from the so-called “wealth effect.” People may feel better off financially and therefore more able to make charitable gifts. Secondly, as the stock market goes up, more people hold appreciated securities and are in a position to use them to make gifts in a tax-wise fashion.

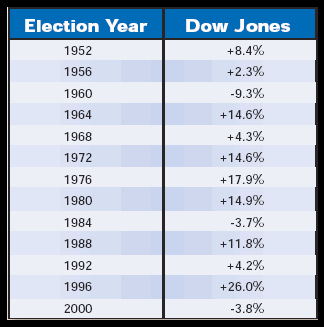

According to Stock Trader’s Almanac, the Dow Jones Industrial Average has risen in 10 of the last 13 presidential election years. The average gain in years of increases was just under 12%:

In the case of the broader S&P 500 index, the average increase in Presidential election years was 9%, with most of the increases coming in the second half of the year.

Note that for the period covered above, the Dow has never been down for two consecutive election years in a row. While past performance does not necessarily predict the future, history would seem to favor an up year for the financial markets in 2004. More importantly, if the Dow stays above the 10,000 level, charities are likely to benefit from the psychological impact of this benchmark. As a result, now may be a good time to compile a listing of all donors who have made gifts of securities in the past and notify them and others of what may be an opportunity to make special gifts this fall.

New report on the wealthy

The April issue of Give & Take reported the findings of a recent IRS study of personal wealth in America. That article focused on individuals with gross assets in excess of $625,000. That group numbered approximately 6.5 million in 1998.

A new report provides more recent information on high net worth individuals, who are defined as those persons with financial assets of at least $1 million, excluding residential real estate.

World Wealth 2004 was commissioned by Merrill Lynch and Capegemini. Specific information concerning high net worth individuals in America is contained in the report. Those included had financial assets in excess of $1 million, excluding home equity. The number of qualifying individuals in the United States climbed to 2,270,000 persons at the end of 2003. This represents an increase of 272,000 persons, or 14%, when compared to the previous year. These numbers reflect the economic recovery which began in the second half of 2003.

According to the report, these millionaires benefited from both significant gains in their long-term equity positions as well as more recent investments in equities. They were among the first investors to shift from low-yielding fixed income securities back into equities and other investments. Lower capital gain and dividend tax rates may have served to help accelerate those changes. Real estate investments continued to be attractive to high net worth individuals as well.

The report found that primary financial objectives shifted between 2002 and 2003. During the 2001 and 2002 period there was a greater emphasis on capital preservation as opposed to a renewed interest in wealth accumulation and distribution. According to the report, the financial services industry continues to acknowledge the increased importance of philanthropic planning services as a part of comprehensive wealth management.