Silent no more.

Hidden in the shadows between the remaining members of the Greatest Generation and the much larger group of baby boomers is another generation we often do not hear much about. While demographers may differ on dates, members of the “Silent Generation,” also known as the “lucky few,” were born in the late 1920s through the mid-1940s. For most of the last century this cohort group was dwarfed by the larger generations directly before and after it. As a result, the Silent Generation collectively has heretofore had a smaller voice in public life.

Things may be getting ready to change. Most of the Greatest Generation has passed from the scene, and their shrinking ranks are comprised of the nation’s oldest citizens— those in their late 80s, 90s and even their 100s.

By contrast, the youngest members of the Silent Generation are just turning 70. As they say, money talks, and this group is silent no more. They will have an increasingly important role to play in philanthropy for the next 15 to 20 years.

Timing is everything.

Benefiting from impeccable timing, the Silent Generation was recently proclaimed by Bloomberg Business “the winners of the life lottery”.

Born for the most part during the Great Depression, this group came of age during the period of economic expansion that followed World War II and the majority had left the work force before the Great Recession hit in 2007. As the value of stocks and real estate increased over time, many built a comfortable retirement nest egg that is buttressed by Social Security, pensions and qualified retirement plans.

What does this mean for philanthropy?

Economic studies indicate that gross household income tends to peak between ages 45 and 55. Consumer spending also tends to peak at that time and then falls in most areas except two—healthcare and charitable expenditures. Indeed, surveys by Blackbaud and Convio report that those 65 and over, currently comprised primarily of the Silent Generation, give more to charity and support more charities than any other generation.

Older donors are also responsible for more noncash gifts—particularly gifts of appreciated securities—than any other age group. While in their top earning years 20 to 30 years ago, many members of the Silent Generation invested in real estate and securities that have generally increased dramatically in value over time. These investments now make an ideal choice for charitable gifts, enabling donors to benefit from deductions for fair market value while they bypass substantial capital gains taxes they would otherwise owe.

Older donors are also responsible for more noncash gifts—particularly gifts of appreciated securities—than any other age group. While in their top earning years 20 to 30 years ago, many members of the Silent Generation invested in real estate and securities that have generally increased dramatically in value over time. These investments now make an ideal choice for charitable gifts, enabling donors to benefit from deductions for fair market value while they bypass substantial capital gains taxes they would otherwise owe.

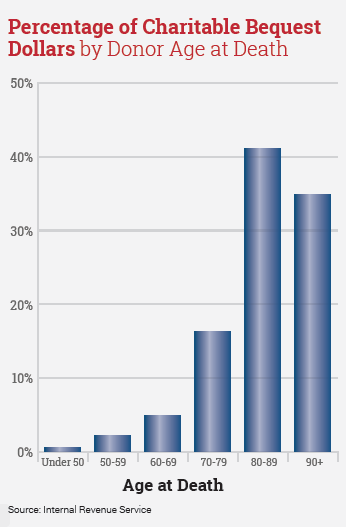

In addition to being an important source for current gifts, the oldest Americans represent the vast majority of maturing planned gift revenue each year. IRS figures indicate\ 92 percent of bequest dollars come from people who die at the age of 70 or older (see chart). Some 57 percent are received from those dying between ages 70 and 89, the current age of the bulk of the Silent Generation. Another 34 percent come from those age 90 and over. IRS data further indicates that only 8 percent of bequest dollars are received from those dying under the age of 70.

Academic research, both in the U.S. and abroad, also confirms that estate plans that result in charitable distributions are typically executed late in life, mostly beyond the age of 75. (See Russell James’s article, “Timing of the Last Will and Testament,” Give & Take, February 2015).

Key aspects of the Silent Generation—including their age and financial resources—make them an important group to focus on when seeking to motivate planned gifts. In particular, consider educating this group about noncash charitable gifts, such as securities and real estate. And don’t overlook the fact that multiple studies show the bulk of this generation has yet to make their final charitable estate plans through their will and similar arrangements.

This Silent Generation is ready to be heard—now and for the next several decades. In the rush to participate in the coming “baby boomer bequest boom” don’t forget that even the oldest baby boomers have a remaining life expectancy of 15 or more years and the Silents represent the best source of increased bequest income over the next two decades.